Newbies might have heard the term “implied volatility” thrown around when they’re first learning about options trading, and some of them might understandably be confused as to what is being referred to. In this article, we’ll tackle implied volatility (IV), and how it impacts option trading.

What is Implied Volatility?

Implied volatility represents the market’s collective expectation of future price fluctuations for a particular asset. More than a mere statistical measure, IV encapsulates the market’s sentiment, capturing the anticipation of both potential profits and looming risks. It is an important factor that can be utilized in effective options trading strategies.

Consider it as the unspoken language of options traders, a code embedded in the pricing of options contracts. When implied volatility is high, market participants have a consensus that the asset’s price will likely experience significant swings. Conversely, low implied volatility suggests a perceived stability, where the market expects more modest price movements.

Understanding implied volatility allows traders to make informed decisions when entering or exiting options positions. Traders can utilize historical data on implied volatility to identify patterns or trends and predict potential future movements in an underlying asset’s price. By assessing whether current implied volatility levels are high or low relative to historical averages, traders can gauge whether options are overpriced or underpriced.

Moreover, implied volatility is vital in determining option strategies suitable for different market conditions. Traders may choose strategies such as buying long straddles or strangles during periods of high implied volatility when they anticipate significant price swings. Conversely, selling covered calls or cash-secured puts may be more appropriate during low implied volatility as they benefit from relatively stable market conditions.

How Does Implied Volatility Affect Options Trading

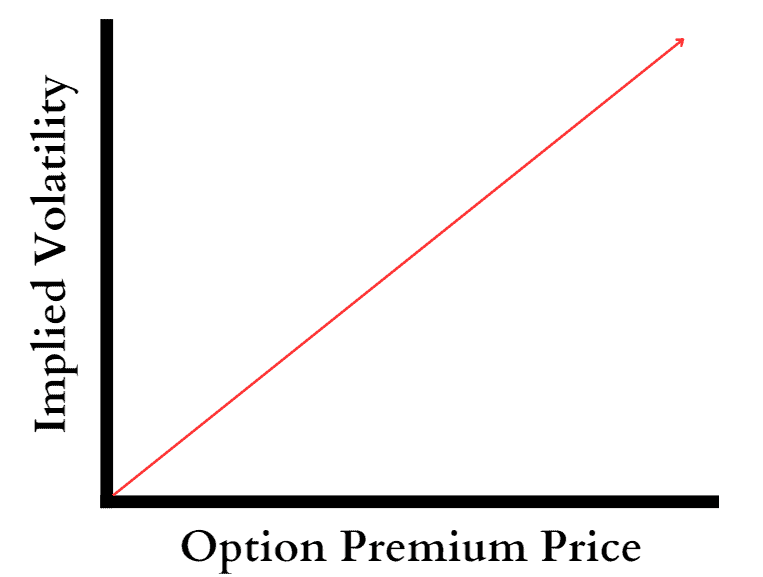

One of the primary reasons why implied volatility holds such importance is its impact on option pricing. As mentioned earlier, implied volatility rises, so does the price of options, as traders are willing to pay more for contracts with greater potential for large price swings. Conversely, when implied volatility decreases, option prices tend to decline.

Understanding and analyzing implied volatility can provide valuable insights into market expectations and potential risks. High implied volatility may indicate uncertainty or upcoming events that could significantly impact an underlying asset’s price. This information allows traders to make informed decisions about their options positions.

Moreover, implied volatility can also help traders evaluate whether an option is overpriced or underpriced relative to historical levels. By comparing current levels of implied volatility with past data, traders can identify opportunities where options may be mispriced due to excessively high or low expectations.

Additionally, implied volatility plays a crucial role in constructing strategies such as straddles and strangles that aim to profit from significant price movements regardless of direction. These strategies heavily rely on changes in implied volatility as they involve buying both call and put options simultaneously.

Factors Influencing Implied Volatility

Understanding these factors can provide valuable insights for options traders seeking to make informed decisions using IV.

1. Market Conditions: Implied volatility is highly sensitive to overall market conditions. During periods of heightened uncertainty or market turbulence, such as economic crises or geopolitical tensions, implied volatility tends to rise as investors seek protection against potential price swings.

2. Supply and Demand Dynamics: Implied volatility is also affected by supply and demand dynamics within the options market. When there is an increase in demand for options contracts, either due to speculative activity or hedging needs, the resulting scarcity can drive up implied volatility.

3. Time to Expiration: The time remaining until an option’s expiration date impacts its implied volatility. Options with longer time frames tend to have higher implied volatilities as they allow for more potential price movements over an extended period.

4. Underlying Asset Price Movements: The magnitude and frequency of underlying asset price movements influence implied volatility levels. If an asset experiences large price swings or exhibits higher historical volatility, it will likely result in higher implied volatilities for options on that asset.

5. Earnings Announcements and Events: Implied volatility tends to rise leading up to significant events such as earnings announcements, regulatory decisions, or product launches that could impact the underlying asset’s value significantly.

6. Interest Rates: Changes in interest rates can affect the cost of carrying positions in the underlying assets and subsequently influence option prices and their implied volatilities.

How To Calculate Implied Volatility In Options Trading

By calculating implied volatility, traders can make informed decisions regarding options pricing and potential investment strategies. Here are the key steps to calculating implied volatility:

1. Define the option’s current market price: The first step is determining the current market price of the option you are interested in. This information can be obtained from various financial platforms or brokerage websites.

2. Choose an appropriate options pricing model: Implied volatility is calculated using mathematical models such as Black-Scholes or Binomial models. Selecting an appropriate model depends on factors like the option type, underlying asset, and market conditions.

3. Input relevant data into the chosen model: To calculate implied volatility, input certain data points into your selected pricing model, including the current option price, strike price, time until expiration, risk-free interest rate, and any dividends associated with the underlying asset.

4. Employ iterative techniques: Calculating implied volatility involves solving complex mathematical equations iteratively until a solution is reached that matches the observed option price closely.

5. Utilize software tools and platforms: While manual calculations are possible for experienced traders, utilizing specialized software or online platforms can simplify and expedite this process significantly.

Implied Volatility in Option Scanners

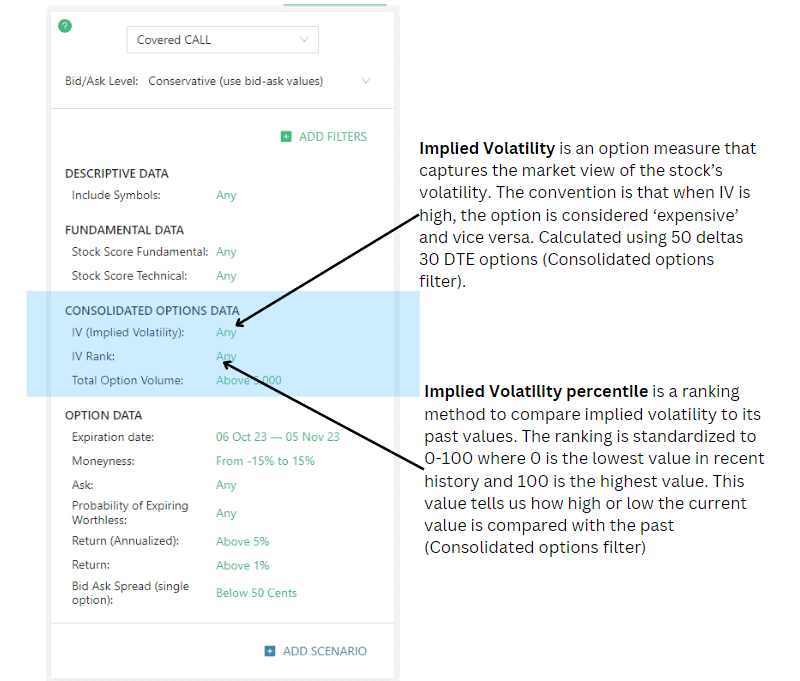

Most, if not all, option scanners utilize implied volatility because it is such an integral part of options trading. Option Samurai, for instance, has Implied Volatility and Implied Volatility Ranking available as search filters.

These values can help both newbie and expert traders alike, making it easier for them to find the best option that fits their chosen strategy. Searches can be further customized by the many available values and filters on Option Samurai.

Implications of IV in Option Prices

Implied volatility represents the market’s perception of the potential future volatility of an underlying asset and is derived from the current market prices of options.

The first implication of implied volatility on option prices is that higher levels of implied volatility generally lead to higher option premiums. When investors perceive a greater chance of substantial price swings in the underlying asset, they demand higher compensation for taking on the associated risks. Consequently, this drives up option prices.

Conversely, lower levels of implied volatility result in lower option premiums. This occurs when market participants anticipate relatively stable price movements or a lack of significant fluctuations in the underlying asset. In such cases, traders are willing to pay less for options due to reduced uncertainty.

Another implication lies in the relationship between implied volatility and time to expiration. Implied volatility tends to increase as an option approaches its expiration date, reflecting heightened uncertainty surrounding future price movements. This phenomenon, known as “volatility skew,” impacts different strike prices within an options contract differently.

Moreover, analyzing implied volatility changes over time can benefit traders seeking profitable opportunities. Significant shifts in implied volatility may indicate changing market sentiment or upcoming events that could impact the underlying asset’s price movement.

Difference Between Implied and Historical Volatility

As mentioned earlier, volatility measures how much a stock price fluctuates over time and plays a crucial role in determining the value of options contracts. Regarding analyzing volatility, two key concepts are often discussed: historical and implied volatility.

Historical or realized volatility refers to the actual price fluctuations observed in an underlying asset over a specific period. It is calculated by measuring the standard deviation of returns from historical data. Historical volatility provides traders with insights into how much an asset’s price has varied historically, which can be useful for forecasting future price movements. By examining past patterns, traders can gauge potential risks and rewards associated with particular options strategies.

On the other hand, implied volatility represents market participants’ expectations regarding future price movements. It is derived from the option’s market price and reflects the collective sentiment of traders and investors. Implied volatility considers supply and demand dynamics, market sentiment, economic news, and upcoming events that may impact the underlying asset’s price. The significance of implied volatility lies in its ability to influence option prices directly. As expectations about future stock price movement change, so does implied volatility.

Strategies For Trading Based On Implied Volatility

Traders often employ strategies to take advantage of implied volatility to profit from anticipated changes in the underlying asset’s price. Here are some commonly used strategies for trading based on implied volatility:

1. Volatility Range Trading: This strategy involves identifying assets with historically stable price ranges and selling options when the implied volatility is high, expecting it to revert to its mean. Traders aim to profit from time decay as the options’ value decreases when the implied volatility declines.

2. Volatility Breakout Trading: Unlike range trading, this strategy focuses on assets experiencing low levels of historical volatility but showing signs of an imminent breakout. Traders buy options when the implied volatility is low, anticipating a significant price movement that could result in substantial profits.

3. Straddle/Strangle Strategy: This strategy involves simultaneously buying both a call and put option with the same expiration date and strike price. Traders utilize this approach when they expect a significant price move but are uncertain about its direction. By profiting from high implied volatility, traders can benefit regardless of whether prices rise or fall.

4. Iron Condor Strategy: This strategy combines selling out-of-the-money put and call options while simultaneously buying further out-of-the-money put and call options as protection. It aims to take advantage of low levels of implied volatility by benefiting from time decay while limiting potential losses through hedging.

5. Calendar Spread Strategy: Traders employ this strategy by simultaneously buying and selling options with different expiration dates but at the same strike price.

Managing Risk With Implied Volatility: The Role Of Option Greeks

To effectively manage risk in options trading, traders often rely on various metrics known as option Greeks. These Greeks help traders assess the sensitivity of option prices to changes in different factors, including implied volatility. One of the most important options Greeks related to implied volatility is Vega.

Vega measures how much an option’s price will change for each 1% change in implied volatility. When implied volatility increases, Vega indicates that the option’s price will rise, and vice versa. Traders can use Vega to estimate potential profits or losses based on changes in implied volatility. Another relevant Greek is Delta, which measures how much an option’s price will change for each $1 change in the underlying asset’s price.

While not directly related to implied volatility, Delta helps traders understand how changes in the underlying asset’s value impact their options positions. By combining Delta with Vega, traders can effectively manage risk by hedging their positions against fluctuations caused by market movements and implied volatility changes. Furthermore, Gamma is another Greek that is crucial when managing risk with implied volatility.

Gamma measures how fast Delta will change for every $1 move in the underlying asset’s price. It helps traders assess how quickly their positions might become more or less sensitive to market movements and changes in implied volatility. By understanding and utilizing these options Greeks – Vega, Delta, and Gamma – traders can make more informed decisions when managing risks associated with changing levels of implied volatility.

Conclusion

Understanding and utilizing implied volatility in options trading provides valuable insights into market expectations and potential price movements. By incorporating this information into their decision-making process, traders can enhance their strategies, manage risk effectively, and potentially achieve greater profitability in the dynamic world of options trading.