Options trading has a few similarities with regular stock trading but has several unique technical values and indicators. Traders dipping their toes in the derivative may encounter new terms, like intrinsic and extrinsic value. This article will illuminate what these terms mean and how they can impact your options trading experience.

Intrinsic Value vs. Extrinsic Value

Intrinsic value refers to the inherent worth of an option based on its relationship to the price of the underlying asset. It is a key factor in determining whether an option is profitable. The intrinsic value of a call option is calculated by subtracting the strike price from the current market price of the underlying asset. If this result is positive, exercising the option would result in an immediate profit. On the other hand, if it is negative or zero, there is no intrinsic value, as exercising the option would not yield any profit. For put options, calculating intrinsic value involves subtracting the current market price of the underlying asset from the strike price instead. A positive result indicates that exercising the put option would result in a profit by selling at a higher market price than its current value.

Meanwhile, extrinsic value, or time value, refers to the additional premium investors are willing to pay for an option above its intrinsic value. One key component of extrinsic value is time decay. As options have expiration dates, their values diminish over time due to the diminishing possibility of a favorable move in the underlying asset’s price. The closer an option gets to its expiration date, the faster its extrinsic value erodes. This means that options with more time until expiration tend to have higher extrinsic values as there is more potential for significant price movements.

Together, the two values make up the premium price for options.

The Importance of Intrinsic and Extrinsic Values of an Option

Both values are important when considering an options trade, and investors and traders must be able to utilize both of them in an effective trading strategy.

A Baseline Indicator

Intrinsic value acts as a baseline indicator of an option’s profitability. Traders must assess whether an option is in-the-money, at-the-money, or out-of-the-money based on its intrinsic value. An in-the-money option possesses positive intrinsic value, indicating that it can be exercised immediately for profit. On the other hand, out-of-the-money options lack intrinsic value and are typically less desirable as they offer no immediate gain upon exercise.

By understanding this distinction, traders can decide which options to buy or sell. Furthermore, intrinsic value plays a pivotal role in determining whether an option is overvalued or undervalued. When an option’s market price surpasses its intrinsic value, it is considered overvalued and may present a selling opportunity for traders seeking to capitalize on this discrepancy. Conversely, if an option’s market price falls below its intrinsic value, it becomes undervalued and may represent a buying opportunity.

A Supplimental Indicator

Meanwhile, extrinsic value supplements intrinsic value by allowing sensitivity to other forces outside of the price of the underlying security and the strike price. One key aspect of option extrinsic value is its sensitivity to time decay. As an option approaches its expiration date, the extrinsic value decreases at an accelerating rate. This phenomenon is particularly relevant for traders who employ short-term strategies or engage in day trading. By recognizing the impact of time decay on an option’s price, traders can identify opportunities to profit from this predictable decline.

Additionally, option extrinsic value provides insight into market expectations regarding future volatility. Higher levels of implied volatility typically lead to increased extrinsic value due to the potential for larger price swings in the underlying asset. Traders who correctly anticipate changes in market volatility can take advantage of these opportunities by buying or selling options accordingly. Moreover, understanding option extrinsic value allows traders to evaluate risk-reward ratios more effectively.

By comparing the amount of extrinsic value with the potential profit from exercising an option or selling it at a later date, traders can assess whether a particular trade is worth pursuing. This analysis helps them determine whether they are paying a fair price for an option contract or if there are better alternatives available. In conclusion, comprehending and considering option extrinsic value is vital for successful options trading.

Factors That Affect Intrinsic Value

Several key factors influence intrinsic value, including:

1. Underlying Asset Price: The most significant factor affecting intrinsic value is the price of the underlying asset. For call options, if the market price is higher than the strike price, there will be positive intrinsic value as exercising allows immediate profit. Conversely, for put options, if the market price is lower than the strike price, there will be positive intrinsic value.

2. Strike Price: The relationship between the strike price and market price directly impacts intrinsic value. In general, a larger difference between these two prices leads to higher intrinsic value for both call and put options.

3. Option Type: The type of option (call or put) also influences intrinsic value differently. Call options have positive intrinsic value when market prices exceed strike prices, while put options have positive intrinsic value when market prices fall below strike prices.

4. Time to Expiration: Intrinsic value diminishes with time as it represents only realizable profit at present rather than potential future gains or losses.

5. Market Volatility: Higher volatility tends to increase both call and put option values as it enhances opportunities for large changes in underlying asset prices.

6. Dividends: For stocks paying dividends before expiration, their impact on option pricing may reduce or increase intrinsic value depending on whether they dilute or enhance stockholder returns.

Limitations Of Intrinsic Value Analysis In Options

While intrinsic value is an essential concept in options trading, it is important to acknowledge its limitations. Intrinsic value analysis alone may not provide a complete picture of an option’s worth, as it fails to consider other factors that influence option prices. Here are some notable limitations of intrinsic value analysis in options:

1. Time Decay: Intrinsic value analysis focuses solely on the current price difference between the underlying asset and the strike price. However, options have a limited lifespan, and their prices are also affected by time decay. As expiration approaches, the time value component of an option diminishes, which can significantly impact its overall worth.

2. Volatility: Options prices are influenced by market volatility. The higher the volatility, the greater the potential for price fluctuations in the underlying asset, making options more valuable. Intrinsic value analysis does not account for this factor and may underestimate or overestimate an option’s worth depending on market conditions.

3. Implied Volatility: Implied volatility represents market expectations of future price movements and is a crucial determinant of option prices. Intrinsic value analysis ignores implied volatility, which can lead to misjudging an option’s true worth.

4. Dividends: If a stock pays dividends during the lifespan of an option contract, it can affect the option’s price as well as its intrinsic value calculation. Failing to consider dividend payments may result in an inaccurate assessment of an option’s profitability.

5. External Events: Economic news releases or corporate announcements can significantly impact stock prices and consequently influence options’ values beyond their intrinsic worth alone.

Factors That Affect Extrinsic Value

The following are some of the key factors influencing option extrinsic value:

1. Time to expiration: The longer the time until an option’s expiration, the higher its extrinsic value. This is because more time allows for greater potential market movements and increases the likelihood of the option becoming profitable.

2. Implied Volatility: Higher volatility increases uncertainty in the market and raises the potential for significant price swings. Consequently, options with higher implied volatility tend to have higher extrinsic values as traders anticipate larger price movements.

3. Underlying asset price: Option prices are influenced by underlying asset price changes. For call options, as underlying prices rise, so does their extrinsic value due to increased potential for profit before expiration. Conversely, put options see their extrinsic value increase when underlying prices decrease.

4. Interest rates: Changes in interest rates can affect option prices due to their impact on opportunity cost and discounting future cash flows. Higher interest rates generally result in lower option premiums and lower extrinsic values.

5. Dividends: Dividend payments made by stocks can also affect options on those stocks. Generally, higher dividends decrease call options’ extrinsic values while increasing put options’ extrinsic values.

Risks Associated With Extrinsic Value

While option extrinsic value can provide traders with potential profit opportunities, it is important to be aware of the risks associated with this aspect of options trading. These risks can have a significant impact on the overall profitability and success of option strategies. Here are some key risks to consider:

1. Time Decay: Option extrinsic value is highly influenced by time decay, also known as theta decay. As an option approaches its expiration date, the extrinsic value diminishes rapidly, leading to potential losses if the underlying asset does not move in the desired direction within the expected time frame.

2. Volatility Changes: Extrinsic value is greatly influenced by changes in market volatility, commonly referred to as implied volatility. If volatility decreases, it could lead to a decrease in extrinsic value and potentially result in losses for traders who rely on increased volatility for profits.

3. Price Movement: Option extrinsic value is affected by price movements in the underlying asset. If the price does not move significantly or moves against the trader’s position, it can lead to a decrease in extrinsic value and potentially result in losses.

4. Liquidity Risk: Options with low trading volumes may have wider bid-ask spreads, making it challenging for traders to enter or exit positions at favorable prices. This lack of liquidity can increase transaction costs and limit profit potential.

5. Market Risk: The overall market conditions and macroeconomic factors can impact option extrinsic value significantly. Unforeseen events such as economic downturns or geopolitical tensions can lead to increased market volatility and adversely affect option prices.

It is essential for options traders to carefully assess these risks associated with option extrinsic value before implementing any trading strategies involving this component of options pricing.

Using Option Scanners

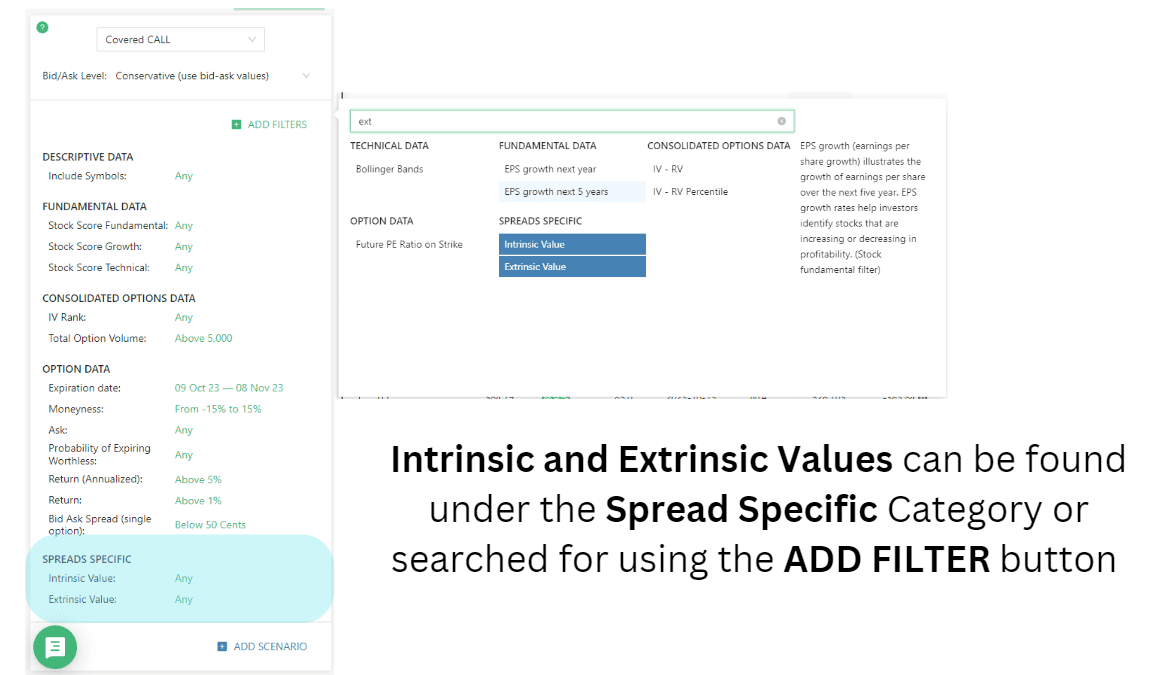

Option scanners like Option Samurai can make your options trading easier by allowing you to customize searches for your preferred trades. Intrinsic and Extrinsic Value can be used as filters for finding the most lucrative trades with your chosen strategy.

Conclusion

Using intrinsic and extrinsic value in options trading requires a comprehensive understanding of their roles in option pricing dynamics. Traders should analyze the interplay between intrinsic and extrinsic values when evaluating option premiums, helping them gauge risk-reward profiles. Additionally, consideration of time decay is crucial, especially for option buyers. Crafting strategies based on these values, such as selling options to capitalize on time decay or adjusting positions in response to changing intrinsic and extrinsic values, enhances risk management. Monitoring volatility and adapting strategies to market conditions contribute to a holistic approach to options trading, enabling traders to navigate the complexities of the derivatives market more effectively.