Risk management is a crucial aspect that investors constantly grapple with when trading stocks and derivatives. Using various hedging strategies is one approach to mitigating potential losses and safeguarding investments. The married put is one such strategy that offers protection against market downturns, ensuring investors have a safety net in place.

A married put, also known as a protective put or portfolio insurance, combines the purchase of an underlying asset with its corresponding put option. This strategy allows investors to protect their investment by setting a predetermined floor price, commonly referred to as the strike price. Should the value of the underlying asset fall below this strike price, investors can exercise their put option and sell it at this predetermined price, limiting potential losses.

The married put strategy is particularly useful for those who are bullish on an asset but still want to protect themselves from unexpected downside risks. By purchasing both the underlying asset and its corresponding put option simultaneously, investors can benefit from any potential upside while minimizing potential losses should the market turn unfavorable.

It’s important to note that while married puts offer downside protection; they also involve additional costs in terms of purchasing both the asset and its associated put option. Therefore, understanding how this strategy fits into one’s overall investment objectives and risk tolerance becomes crucial before implementing it into one’s portfolio.

This article will delve deeper into how married puts work, discuss their advantages and disadvantages, explore practical applications in real-world scenarios, and provide insights into evaluating whether they are suitable for individual investment goals.

The Benefits Of Using A Married Put Option Strategy

The married put strategy provides investors with an effective tool to protect their portfolio against potential downside risks while allowing them to participate in any potential upside movement. One of the key benefits of using a married put strategy is its ability to limit potential losses.

By purchasing put options, investors have the right to sell their stock at a predetermined price, known as the strike price. This means that even if the stock price significantly declines, they can still sell it at a higher price, effectively limiting their losses.

Another advantage of this strategy is its flexibility. Investors can choose strike prices and expiration dates based on risk tolerance and market outlook. This allows them to customize their investment approach according to their needs and preferences.

Furthermore, by using married puts, investors can also benefit from leverage. Put options typically cost less than buying additional shares of stock outright, allowing investors to control more shares for less capital outlay. This leverage amplifies any potential gains if the stock price rises. Additionally, married puts provide peace of mind for investors during volatile market conditions or when holding stocks with uncertain prospects.

The protective nature of this strategy ensures that even in turbulent times, investors have a level of insurance against significant losses. In conclusion, utilizing a married put strategy offers several advantages, such as downside protection through limited losses, flexibility in strike prices and expiration dates, leverage for potential gains, and peace of mind during market uncertainty.

How Does The Married Put Strategy Work?

By combining stock ownership with put options, the married put strategy allows investors to limit potential losses if the stock price declines while still participating in any potential upside. If the stock price decreases significantly, investors can exercise their right to sell their shares at the strike price by exercising the put option. This ensures they can exit their position at a predetermined level and minimize further losses.

On the other hand, if the stock price increases or remains stable, investors can continue holding onto their shares and benefit from any upward movement in value. They have complete control over whether or not they choose to exercise their put option.

The married put strategy allows investors to hedge against downside risk without completely liquidating their positions. It allows them to maintain exposure to potential gains while limiting potential losses. However, it is important for investors to carefully consider factors such as premium costs and expiration dates when implementing this strategy effectively.

Step-By-Step Guide

Implementing a married put trade involves combining the purchase of a stock with the purchase of a put option on that same stock. This strategy is commonly used by investors who want to protect their stock position from potential losses while still maintaining the opportunity for capital appreciation. Here is a step-by-step guide to implementing a married put trade:

1. Identify the Stock: Begin by selecting the stock you want to invest in. Consider factors such as company fundamentals, industry trends, and market conditions.

2. Research Put Options: Explore available put options for your chosen stock. Assess factors like expiration dates, strike prices, and premiums associated with these options.

3. Calculate Position Size: Determine the number of shares you wish to buy based on your risk tolerance and available capital.

4. Purchase Stock: Execute your plan by buying the desired number of shares in the selected stock through your brokerage account.

5. Buy Put Option: Simultaneously purchase a put option contract for each share of stock you own. Ensure that the strike price and expiration date align with your investment objectives.

6. Monitor Your Position: Regularly review market conditions and keep track of any changes in the value of both your stock and put option.

7. Manage Risk: Evaluate potential scenarios where losses may occur, taking into account changes in stock price and time decay on the option contract.

8. Adjust or Exit Position: If necessary, make adjustments or exit your position by selling either part or all of your holdings based on market conditions or risk appetite changes.

Common Mistakes To Avoid When Using Married Puts

While married puts can provide downside protection and limit potential losses, there are common mistakes that investors should avoid.

One common mistake is failing to understand the cost implications of married puts. Buying put options can be expensive, and investors must consider the premium paid. Evaluating whether the potential gains from using married puts outweigh the costs involved is crucial.

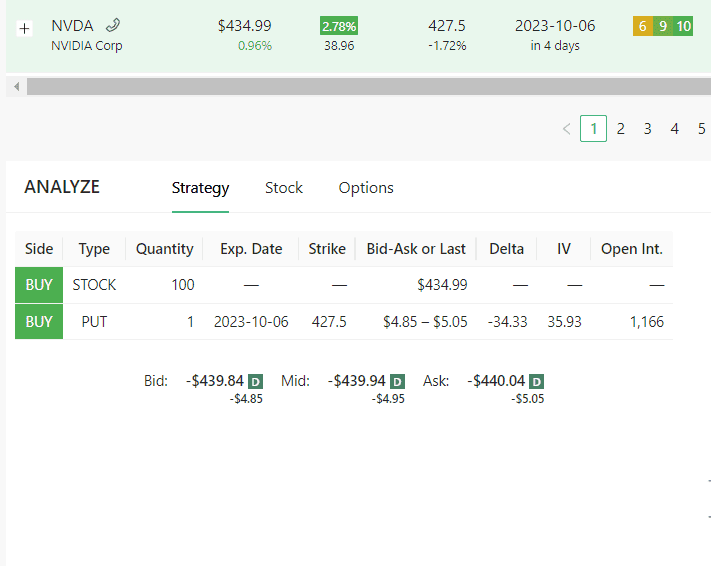

Here’s an example from Option Samurai as to how much a put option can cost, using Nvidia Corporation (NVDA).

Since premiums are expressed as price per share, $4.85 to $5.05 must be multiplied by 100 to purchase the price per put option. This means that if the trader owns 200 shares of NVDA stocks and wants to purchase put options, they must pay $970 to $1,010.

Another mistake is selecting the put options’ inappropriate strike prices and expiration dates. Choosing strike prices too close to the current stock price may result in costly premiums or limited downside protection. Additionally, selecting expiration dates too short may not provide adequate coverage for long-term investments.

Timing is also critical when using married puts. Investors should avoid purchasing put options during periods of high market volatility or when they anticipate a significant increase in stock value. These situations can inflate option premiums and reduce overall profitability.

Lastly, overlooking ongoing monitoring and adjustment of married puts can be detrimental. Market conditions change over time, and it is important to reassess positions periodically. Failing to adjust or exit a married put strategy when needed may result in unnecessary expenses or missed opportunities.

By avoiding these common mistakes, investors can maximize the benefits of using married puts while minimizing potential risks associated with this investment strategy.

Analyzing The Potential Risks And Drawbacks Of Married Puts

The cost of buying a put option acts as an insurance premium, providing downside protection but reducing potential profit if the market performs well. Additionally, depending on market conditions, the price of put options may vary significantly, further affecting overall costs. Another drawback to consider is time decay or theta. As time passes, options lose value due to decreasing probability of reaching a profitable outcome.

This means that even if the underlying asset remains stable or increases in value, the put option’s worth may decline over time. Consequently, investors must carefully assess how long they expect their hedging needs to persist to avoid unnecessary expenses. Furthermore, married puts do not entirely eliminate risk in volatile markets; rather, they mitigate it by providing limited downside protection. If prices drop significantly or unexpectedly, losses may still occur despite having a protective put option in place.

Lastly, successfully implementing married puts requires skillful timing and accurate market predictions. If an investor misjudges when to enter or exit a position or incorrectly gauges market movements, losses may be incurred even with this hedging strategy.

Top Industries And Stocks Suitable For Married Put Strategies

When implementing a married put strategy, it is crucial to select industries and stocks that align with the objectives of this investment approach. The married put strategy involves purchasing a put option alongside a long position in the underlying stock, providing downside protection while allowing for potential upside gains. Here are some industries and stocks that are particularly suitable for implementing married put strategies:

1. Technology Sector: With rapid advancements in technology, this sector offers immense growth potential. Companies involved in software development, cloud computing, artificial intelligence (AI), and cybersecurity can be considered for married put strategies. These sectors often experience high volatility but can deliver substantial returns.

2. Healthcare Industry: As healthcare continues to evolve and innovate, companies operating in pharmaceuticals, biotechnology, medical devices, or healthcare services present attractive opportunities for married put strategies. This industry is known for its resilience during economic downturns due to the constant demand for healthcare products and services.

3. Consumer Goods: Companies in consumer goods sectors such as retail, food and beverage, personal care products, or household essentials often display stable performance even during economic uncertainties. These industries can be suitable candidates for married puts due to their ability to weather market volatility.

4. Renewable Energy: With increasing global concerns about climate change and sustainability, renewable energy companies have gained significant attention from investors. Solar power producers, wind energy firms, electric vehicle manufacturers, or clean technology providers offer potential growth prospects while aligning with environmentally conscious investing strategies.

Married Puts vs. Covered Calls And Other Strategies

The married put is a unique approach that offers distinct advantages over other methods.

The married put strategy provides downside protection than simply holding a long stock position. While owning stocks alone exposes investors to market volatility and potential losses, purchasing a put option alongside the stock allows for a limited risk scenario.

If the stock price declines significantly, the put option provides an opportunity to sell the stock at a predetermined price, limiting potential losses. In contrast to buying protective puts alone, which can be expensive and erode profits due to premium costs, the married put strategy offers an advantage.

By simultaneously purchasing both the underlying asset (stock) and its corresponding put option, investors can mitigate premium costs as they partially offset each other.

Furthermore, when compared to stop-loss orders or trailing stops – commonly used risk management tools – married puts offer more flexibility in managing downside risks. Stop-loss orders automatically trigger selling when prices fall below a specified level; however, this may lead to premature exits during temporary market downturns. In contrast, married puts provide greater control as investors can decide whether or not they exercise their right to sell at any given time within the option’s expiration period.

Covered Calls

One similar strategy is the covered call. A call strategy is owning the underlying stock (like a married put) and selling call options on that stock. The call options give the buyer the right to purchase the stock at a specified price before a predetermined expiration date. This strategy generates income through the premiums received from selling the call options, which is used to offset any losses in case the stock price drops. However, it also limits the potential upside gain on the stock, as the investor is obligated to sell the stock if the call option is exercised.

In essence, a married put is a protective strategy that limits downside risk, while a covered call is an income-generating strategy that limits potential upside gain. Each strategy has its own risk-reward profile and is suited to different market conditions and investor objectives.

Finally, it is important for investors considering married puts to understand that this strategy involves additional costs associated with purchasing options and requires careful monitoring of market conditions and timing decisions.

Tips For Choosing The Right Options For Your Married Put Trade

When considering a married put trade, selecting the right options is crucial to maximize potential gains and protect against downside risks. Here are some key tips to help you choose the most suitable options for your married put strategy:

1. Determine your risk tolerance: Before selecting options, assess your risk tolerance level. Higher-risk investors may prefer out-of-the-money (OTM) puts, which offer lower upfront costs but provide less protection. Conversely, more risk-averse individuals might opt for in-the-money (ITM) puts that provide greater downside protection.

2. Analyze underlying stock volatility: Volatility can greatly impact option prices. If you anticipate high stock volatility, consider OTM puts with longer expiration dates to benefit from potential price swings. Conversely, if the underlying stock is relatively stable, ITM puts with shorter expiration dates may be more appropriate.

3. Assess time decay: Options lose value as expiration approaches due to time decay or theta decay. Consider this factor when choosing the expiration date of your married put options. Longer-dated options may provide more time for the stock to move favorably and protect against potential losses.

4. Evaluate liquidity: Opt for highly liquid options that have a significant trading volume and tight bid-ask spreads. This ensures ease of entry and exit from positions without suffering from poor execution or excessive transaction costs. 5. Consider cost efficiency: Compare premiums of various strike prices and expiration dates to find a balance between cost and protection level provided by the married put strategy.

Conclusion: Is A Married Put Strategy Right For You?

The married put strategy is particularly suitable for individuals who are bullish on a particular stock but want to protect themselves from unforeseen market downturns. It allows them to participate in any potential upside while limiting their downside risk. This approach can be especially beneficial for long-term investors who are committed to holding onto their stocks but want to guard against significant losses in case of adverse market conditions.

However, it is important to note that employing the married put strategy involves additional costs. These costs include not only the premium paid for purchasing put options but also the opportunity cost of tying up capital in these options instead of other investment opportunities. Therefore, investors should carefully evaluate whether these expenses are justified based on their risk tolerance and investment goals.

Ultimately, whether or not a married put strategy is right for you depends on your individual circumstances and objectives as an investor. It may be worth considering if you desire protection against potential stock declines without sacrificing your position entirely. However, before implementing this strategy, consulting with a financial advisor or professional is strongly recommended to ensure it aligns with your overall investment plan and risk profile.