The long strangle options strategy is a popular trading technique used in financial markets. Investors and traders primarily employ it if they expect significant price volatility soon. This strategy allows market participants to potentially profit from price movements in either direction while minimizing risk. A long strangle involves buying both a call option and a put option with the same expiration date but different strike prices.

The strike prices are set above and below the current market price of the underlying asset. By purchasing both options simultaneously, traders create a “long strangle” around the current market price, hence its name. The primary objective of employing this strategy is to take advantage of large price swings that can occur due to various events such as earnings announcements, economic reports, or geopolitical developments.

Traders anticipate that these events will cause significant volatility but are unsure about the direction in which prices will move. When implementing a long strangle strategy, traders must consider two crucial factors: strike selection and expiration date. The chosen strikes should be far enough from the current market price to allow for potential movement in either direction. Additionally, selecting an appropriate expiration date is vital as it determines how long traders have before their options expire.

What is a Long Strangle Strategy

One of the key benefits of using a long strangle strategy is its limited risk exposure vis-a-vis other strategies like naked calls or puts. Since both call and put options are purchased simultaneously, losses are capped at the initial investment to acquire these options. However, it’s important to note that while long strangle offers limited risk exposure, they also come with potential limitations, such as higher transaction costs due to buying two options instead of one.

Moreover, if the expected price volatility does not materialize within the specified time frame or if prices remain relatively stable, traders may experience losses due to time decay eroding their option values. Overall, the long strangle options strategy provides traders a flexible approach to capitalize on significant price movements, regardless of market direction.

How Does It Work?

In a long strangle strategy, the investor purchases an out-of-the-money call option and an out-of-the-money put option. An out-of-the-money call option means that the call option’s strike price is higher than the current market price of the underlying asset. On the other hand, an out-of-the-money put option has a strike price lower than the current market price.

This strategy aims to profit from large movements in either direction without speculating on a specific outcome. By buying both options, investors are essentially betting that there will be significant volatility in either direction during the lifespan of these options.

If there is a substantial price increase, then you can profit by exercising or selling the call option while allowing the put option to expire worthless. Conversely, if there is a significant decrease in price, then profits can be made by exercising or selling the put option while allowing the call option to expire worthless.

It’s important to note that since both options are purchased out-of-the-money, they are cheaper compared to at-the-money or in-the-money options. This makes it more accessible for traders with limited capital as they can participate in potential profit opportunities without having to invest heavily upfront.

However, one drawback of this strategy is that it requires substantial movement in order to be profitable due to buying two separate options contracts. If there isn’t enough volatility within a given timeframe, both options may expire worthless, resulting in losses for investors.

Advantages And Disadvantages Of Using A Strangles Strategy

The long strangle options strategy is a popular choice for traders looking to profit from volatility in the market. It involves simultaneously buying an out-of-the-money call option and an out-of-the-money put option with the same expiration date. This strategy offers several advantages and disadvantages that traders should consider before implementing it.

Advantages

One of the primary advantages of using a long strangle strategy is its potential for high profitability.

Since this strategy profits from increased volatility, it can generate substantial returns if the underlying asset experiences significant price movements. Unlike other options strategies that require specific price movements to be profitable, a long strangle can be profitable in both bullish and bearish market conditions. Another advantage of the long strangle strategy is its flexibility. Traders have the freedom to adjust their positions based on changing market conditions.

They can modify their options’ strike prices or expiration dates to better align with their outlook on the underlying asset’s future price movement. This flexibility allows for greater adaptability in response to evolving market trends. Additionally, implementing a long strangle is relatively straightforward compared to other complex options strategies, such as iron condors or butterflies. Traders do not need an extensive understanding of advanced options strategies or complex mathematical models to execute this strategy effectively.

Disadvantages

This simplicity makes it accessible to both novice and experienced traders alike. However, despite its advantages, there are some disadvantages with using a long strangle strategy. One significant disadvantage is that it requires precise timing for maximum profitability. Since this strategy relies on significant price movements within a specific timeframe, losses may be incurred if these movements do not occur within the expected timeframe.

Moreover, due to its reliance on volatility, there is always a risk that markets may remain stagnant or experience low levels of volatility during certain periods. In such situations, both call and put options may lose value rapidly as time decay erodes their premiums. In conclusion, while employing a long strangle strategy can offer potential benefits such as high profitability and flexibility, it has drawbacks.

Key Components Of A Strangles Trade

As stated earlier, the long strangle options strategy involves purchasing both a put option and a call option with different strike prices but with the same expiration date. Unlike other options strategies, such as straddles, which require the underlying asset to move significantly in one direction, long strangle allows traders to profit from substantial price fluctuations in either direction.

Several key components make up a long strangle trade:

1. Call Option: The first component of a long strangle trade is purchasing a call option. This gives the trader the right, but not the obligation, to buy the underlying asset at a specified strike price before the expiration date.

2. Put Option: The second component is buying a put option. This gives the trader the right, but not the obligation, to sell the underlying asset at a predetermined strike price before expiration.

Attributes of a Long Strangle

Different Strike Prices:

The call and put options in a long strangle trade have different strike prices. The call option’s strike price is typically above the asset’s current market price, while the put option’s strike price is usually below it.

Same Expiration Date

Both options in a long strangle trade must have identical expiration dates. This allows traders to take advantage of potential market movements within that timeframe.

Volatility Expectation

Strangles are most effective when there is an anticipated increase in market volatility. Traders use this strategy when they believe an asset’s price will experience significant movements in either direction.

Risk Management

Risk management is essential in executing successful long strangle trades as they involve buying both call and put options simultaneously, which can be costly if not managed properly.

By combining these key components and carefully analyzing market conditions and volatility expectations, traders can potentially profit from significant price swings regardless of whether they occur upwards or downwards. However, it is crucial to note that long strangle are complex strategies and require a thorough understanding of options trading before implementation.

Implementing The Strangles Strategy: Step-By-Step Guide

The long strangle options strategy is a popular and versatile trading technique that allows traders to profit from bullish and bearish market conditions. It involves the simultaneous purchase of out-of-the-money (OTM) call and put options with different strike prices but the same expiration date. This strategy aims to benefit from significant price movement in either direction, while also limiting the potential loss.

Here’s What To Do

1. Identify an underlying asset: Choose a stock, index, or ETF that you believe will experience significant volatility in the near future. Look for assets with high implied volatility as it increases the premium received from selling the options.

2. Determine strike prices: Select an OTM call option with a higher strike price above the current market price and an OTM put option with a lower strike price below it. The difference between these two strikes creates a profit zone where gains can be made.

3. Calculate position size: Assess your risk tolerance and allocate appropriate capital for this trade based on your account size and risk management rules.

4. Place orders: Execute separate buy orders for both call and put options through your chosen brokerage platform at their respective prices.

5. Set expiration date: Ensure that both call and put options have the same expiration date to maintain symmetry in this strategy.

6. Monitor position: Regularly review market conditions, including any news or events that may impact your chosen asset’s volatility or direction of movement.

7. Adjust or close position: If market conditions change significantly, consider adjusting your position by rolling up or down one leg of the long strangle to adapt to new expectations or closing out entirely if necessary.

8. Manage risk: Implement stop-loss orders to limit potential losses if the trade goes against you beyond predefined thresholds.

The long strangle options strategy requires careful analysis of market conditions and the ability to manage risk effectively. By following this step-by-step guide, you can implement the long strangle strategy with greater confidence and potentially benefit from market volatility.

Risk Management Techniques For Strangles Trades

Strangles, a popular options strategy, involves simultaneously buying both a call option and a put option with the same expiration date but different strike prices. This strategy is commonly employed by options traders to profit from market volatility without having to predict the direction of the price movement. However, like any trading strategy, long strangle come with their own set of risks.

Effective risk management is crucial for maximizing potential gains while minimizing potential losses.

Key Risk Management Techniques for Long Strangle Trades

1. Define risk tolerance: Before entering into any trade, it is essential to determine your risk tolerance level. Assessing how much loss you can comfortably bear will help you decide the appropriate strike prices and expiration dates for your long strangle options.

2. Set stop-loss orders: Implementing stop-loss orders can protect against substantial losses in case the price moves significantly against your position. A stop-loss order automatically triggers a market order to close your position if the price reaches a predetermined level.

3. Monitor implied volatility: Implied volatility plays a critical role in determining the value of options contracts. Keep an eye on changes in implied volatility, as it can affect both sides of your long strangle trade.

Higher implied volatility increases option prices, while lower implied volatility decreases them.

4. Adjust or roll positions: As expiration approaches, market conditions may change or move differently than anticipated. If necessary, consider adjusting or rolling your positions by closing out one side of the long strangle and opening new positions at different strike prices or expiration dates.

5. Diversify and manage position size: Avoid placing all your capital on one single trade; instead, diversify across multiple long strangle trades with different underlying assets and expiry dates to spread out risk exposure.

6. Continuous monitoring and analysis: Keep track of market trends, news events, and technical indicators that could impact the underlying asset’s price movement during the life of your long strangle trade. Regularly reassess your positions and adjust your risk management strategies accordingly.

Real-Life Examples Of Long Strangle Trade

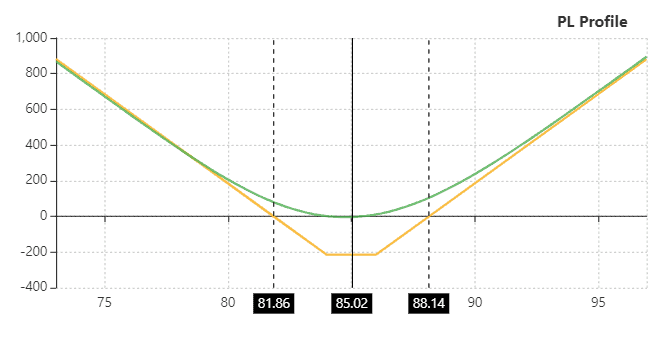

Let’s take a real-life stock and apply the long strangle strategy. Walt Disney Company (DIS) is trading at $85.02 during the time of writing. If we use a long strangle here, it would look something like this:

Using an options scanner like Option Samurai, we see that on this day, we can buy a put with a $84 strike price and a September 29 expiration for about $1 premium. The call option is more pricey at between $1.14 and $1.17, with a $86 strike price and the same expiration date. This is the trade plotted in a PL graph:

Breakeven

The breakeven prices are indicated with the dotted line. These are the price levels the stock must reach in either direction to recoup the premium paid for the options. This means that DIS must decrease or increase by approximately 3.8% for the strangle to profit.

Profit

The strangle is profitable if prices exceed breakeven points before. Since the strangle covers both directions, the option placed opposite the actual price direction will expire worthless, while the option in the correct direction will expire in the money. Profits are theoretically unlimited on the upside since it’s possible for a stock price to increase more and more, while profits on the downside are limited to the put’s strike price (realized when the stock price hits 0).

Loss

The loss scenario is realized when both options expire out of the money. The total loss is limited to how much premium the trader paid for the options.

Conclusion: Is The Strangles Options Strategy Right For You?

The long strangle options strategy is a versatile and potentially profitable trading strategy that can be suitable for certain traders. However, before deciding whether it is right for you, it is crucial to consider various factors and understand the potential risks involved.

One of the key advantages of the long strangle options strategy is its flexibility. By combining both a long call option and a long put option with different strike prices, traders can profit from significant price movements in either direction. This strategy allows investors to take advantage of market volatility without needing to predict the exact direction of the underlying asset’s price movement.

Furthermore, long strangles typically require lower initial investment costs than other strategies like straddles.

However, it is important to note that the long strangle options strategy has inherent risks. The most significant risk is that if the underlying asset’s price remains relatively stable during the contract period, both options may expire worthless and result in a total loss of investment. Additionally, as this strategy involves holding two options simultaneously, higher transaction costs are associated with implementing and managing this position.

The suitability of the long strangle options strategy depends on an individual trader’s risk tolerance, market outlook, and trading experience. Traders who are comfortable with potentially unlimited profit potential coupled with defined risk may find this strategy appealing. Additionally, those who believe in high levels of market volatility or have a neutral outlook on an underlying asset’s price movement may benefit from employing this strategy.

Before implementing this strategy, it is essential to thoroughly educate yourself about options trading and understand how each component of a long strangle works. Consider consulting with a financial advisor or experienced trader who can provide guidance tailored to your needs.