The options market can seem complex and intimidating, especially for beginners. However, with the proper knowledge and strategy, options can provide a powerful tool to enhance your investment returns. One popular strategy among novice traders is the covered call option strategy.

The covered call option strategy involves selling call options on stocks you already own. It is considered one of the most straightforward and conservative options strategies, making it an ideal starting point for beginners who want to generate a little extra income by dipping their toes into options trading.

The concept behind this strategy is relatively simple. As a stock owner, you can sell your shares at a predetermined price (the strike price). If you sell covered calls for the shares you own, you give someone else (the option buyer) the right to purchase your stock at that strike price within a specified period.

In exchange for granting this right, you receive a premium from the buyer of the call option. This premium compensates for potentially giving up any gains beyond the strike price if your stock’s value increases significantly before expiration.

The covered call strategy offers several benefits for beginners.

First and foremost, it allows investors to generate additional income from their existing stock positions through premium collection. This income can be an attractive supplement to regular dividends or other earnings streams.

Furthermore, they can use a covered call to earn a premium from stocks that they want to keep for the long term.

Moreover, this strategy provides downside protection by reducing cost basis if executed correctly. If the stock remains stagnant or declines slightly in value during the life of the option contract, you still retain ownership while collecting premiums and reducing your overall investment cost.

Understanding The Basics Of Options Trading

Options trading is a type of financial derivative that allows investors to speculate on the future price movement of an underlying asset. An option is a contract that gives the holder the right, but not the obligation, to buy or sell an asset at a predetermined price (strike price) within a specific period (which ends at the expiration date). Call options give investors the right to buy an asset, while put options give them the right to sell it.

If those definitions are a bit technical, consider options as directional bets as to where you think the stock or asset price will go within the contract period. Buying call options are bullish, while buying put options are bearish.

Unlike selling cash-secured puts, in a covered call option strategy, you own shares of an underlying asset, such as stocks or exchange-traded funds (ETFs). You then sell call options against those shares. By doing so, you receive a premium from the buyer of the call option. This premium acts as compensation for giving someone else the right to purchase your shares at a specific price (known as the strike price) within a certain timeframe (known as expiration).

The goal of this strategy is for your shares to either remain below the strike price by expiration. If this occurs, your shares will not be sold, and you keep both your shares and the premium received from selling the call option. However, if your shares exceed the strike price by expiration, they will be sold at that price.

Benefits And Risks Of The Covered Call Strategy

The covered call strategy is a popular options trading strategy that can benefit beginners looking to generate income from their investments. However, like any investment strategy, it also comes with risks. Newbie option traders must take a balanced view of all strategies they attempt to use. Let’s break down the risks and benefits of covered calls:

Advantages

- One of the key benefits of using the covered call strategy is that it allows investors to generate additional income from their existing stock holdings. By selling call options on stocks they already own, investors can collect premiums, which serve as an additional source of income. This can be especially attractive in a low-interest-rate environment where traditional fixed-income investments may not provide sufficient returns. If the option expires with the same stock price as your strike price, the total income you receive will be higher than if you sell the stock in the market.

- Another advantage of the covered call strategy is that it provides some downside protection. Since you already own the underlying stock, if its price fell significantly, you would still have some cushioning from the premiums collected by selling call options. This can help mitigate potential losses and provide comfort for conservative investors.

Disadvantages

- One main risk is that selling a call option on your stock holdings limits your potential profit if the stock price rises above the strike price before expiration. In such cases, you would have to sell your shares at a predetermined price (strike price), missing out on any further gains.

- If the stock price were to decline significantly after selling a covered call option against it, you could experience substantial unrealized losses as your shares decrease in value while still being obligated to sell them at a higher strike price. That said, if the stock price declined significantly, so would the call options’ premium, so you could close out the trade by buying back the same call option that you sold- likely for pennies on the dollar.

It’s crucial for beginners to carefully consider these benefits and risks if they want to sell covered calls or if they want to implement any other investment strategies. Seeking advice from financial professionals or conducting thorough research to ensure this approach aligns with individual risk tolerance and financial goals.

Step-By-Step Guide To Implementing A Covered Call Trade

Implementing a covered call trade can be an effective strategy for beginners looking to generate income from their stock holdings. This strategy involves selling call options on stocks you already own, allowing you to earn premiums while potentially profiting from any increase in the stock price. Here is a step-by-step guide on implementing a covered call trade:

1. Choose the Right Stock

Begin by selecting a stock that you own and are willing to sell if the price reaches the call option’s strike price. Choosing a stock with relatively stable prices and moderate volatility is advisable.

2. Determine Strike Price and Expiration

Decide on an appropriate strike price and expiration date for your call option. The strike price should be higher than the current market price of your stock, while the expiration date should provide enough time for potential appreciation.

3. Research Option Premiums

Conduct thorough research on option premiums available for your chosen strike price and expiration date. Typically, strike prices closer to the current asset price are higher, garnering more upfront earnings but implying a higher assignment risk. Strike prices farther from the purchase price have lower premiums, resulting in commensurately lower income and lower risk.

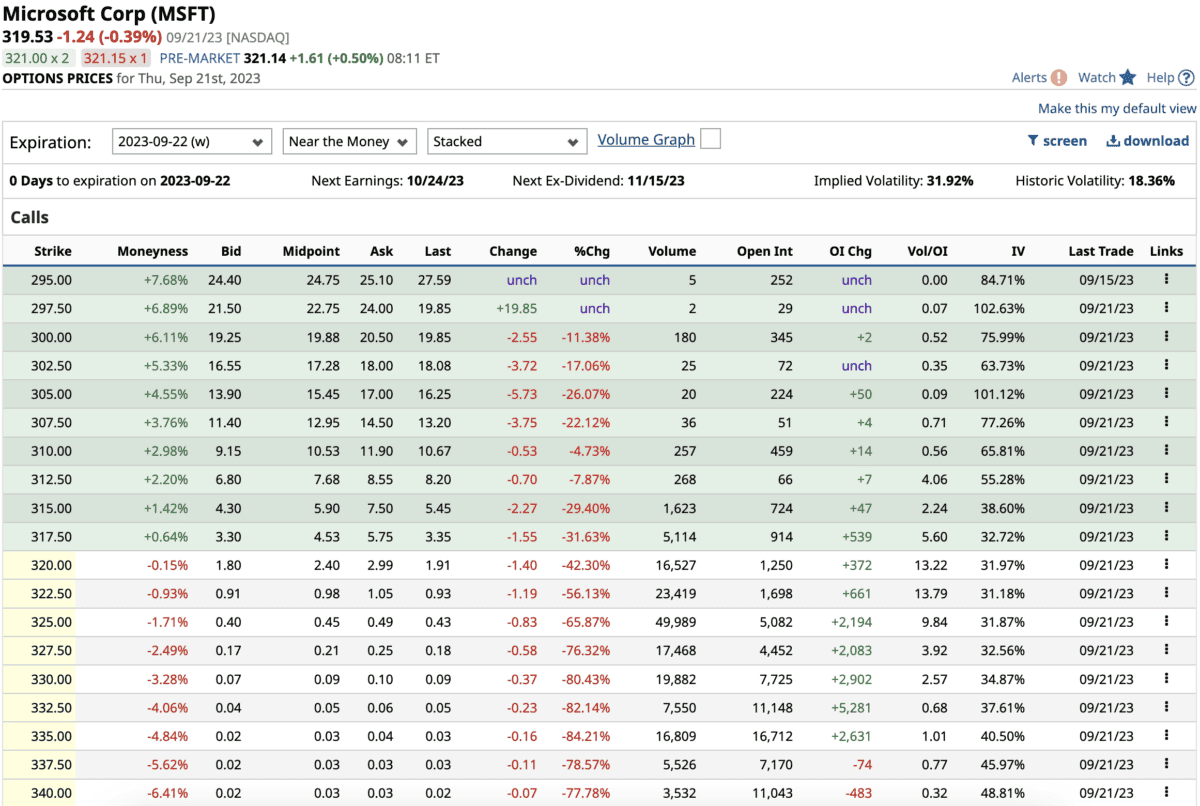

In the example above, we see MSFT currently trading at $319.53. If you were to sell a covered call against MSFT, you might chose a strike price above the the current trading price (in yellow). These are OTM options.

4. Sell Call Options

Once you have identified suitable premiums, sell call options on your chosen stock through your brokerage account. Each option contract represents 100 shares of the underlying security. And, naturally, that means you need to have at least 100 shares of the stock for each contract you’ll sell.

5. Monitor Market Conditions

Monitor market conditions and track any changes in the stock’s value or volatility levels that may impact your trade.

6. Evaluate Potential Outcomes

Assess various scenarios and potential outcomes based on different movements in the underlying stock’s price before expiration.

7. Close or Roll Over Position

As expiration approaches, you have a few options.

- You could buy back the option(s) if there’s a risk of assignment and

- Optionally, you could roll your position by selling new options with later expiration dates.

Selecting The Right Stocks For Covered Calls

When implementing a covered call option strategy, carefully select the stocks that will serve as the underlying assets for your options. Choosing the right stocks can significantly impact the success of your strategy and maximize potential returns. Here are some factors to consider when selecting stocks for covered calls:

Stable and Established Companies

Look for well-established companies with a proven track record of stability and profitability. These companies tend to have less volatility and are more likely to provide reliable dividend payments.

Dividend Yield

One of the key benefits of covered calls is generating income from both dividends and option premiums. Consider stocks that offer attractive dividend yields, as this will enhance your overall return on investment.

Liquidity

Opt for highly liquid stocks with significant trading volume. Adequate liquidity ensures you can easily enter or exit positions without facing slippage or substantial bid-ask spreads.

Volatility

While stability is desirable, it’s important to balance stability and volatility. Stocks with moderate volatility levels can earn higher premiums while maintaining an acceptable risk level.

Technical Analysis

Utilize tools such as charts, trends, and indicators to assess stock price movements over time. This analysis can help identify potential entry points at favorable prices.

Diversification

Maintain a diversified portfolio by selecting stocks from different sectors or industries, reducing exposure to any specific market segment’s risks.

Risk Appetite

Consider your risk tolerance when choosing stocks for covered calls. Conservative investors may prefer blue-chip companies with steady growth prospects, while more aggressive investors might opt for smaller-cap or high-growth potential stocks.

Calculating Potential Profits And Losses In Covered Call Trades

One of the key aspects of implementing a covered call option strategy is understanding how to calculate potential profits and losses. This knowledge allows beginners to make informed decisions when entering into such trades.

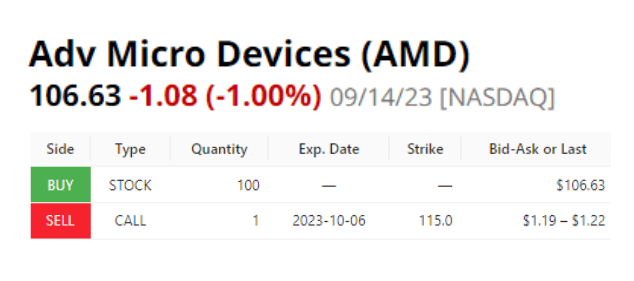

Let’s take a real-life stock to illustrate how a covered call can profit.

In this example, the investor buys 100 shares of Advance Micro Devices (AMD) for $106.63, then writes or sells the option with a $115 strike price, a premium between $1.19 and $1.22 per share, and an expiration date of October 6.

When calculating potential profits and losses, there are three scenarios to consider:

Stock price goes below the strike price but above purchase price (out of the money / OTM)

The stock price remains below $115 but above $106.63 until expiration on October 6. The investor keeps the premium received ($1.19 to $1.22 per share, or $119 to $122 total) from selling the call option and still owns their shares of stock. Furthermore, there are no unrealized losses since the stock price is still above the purchase price.

Stock price goes above the strike price (in the money / ITM)

If AMD trades above $115 at expiration, the option will be exercised, and the shares will be assigned. For example, if AMD stock prices reach $120 on October 6 and the call is assigned, you’ll sell your shares for $115 each, and keep the premium for a total profit of $9.56/share * 100 * the number of contracts sold.

Stock price falls below the purchase price

In this scenario, the call option will expire worthless, and the investor will keep the premium. The investor faces unrealized losses from the difference between the stock price and purchase price. However, losses are offset by the premium received for the call option.

This PL Profile from Option Samurai shows the potential scenarios. The X axis is the stock price, while the Y axis represents profits/losses. The green line represents the possible profit or loss if the option is exercised today with its current stock price, while the yellow line indicates the possible profit or loss at expiration. The graph works by showing the expected returns at every price level.

So, if we slide the line over the $115 strike price, we can see that the maximum profit on expiration (October 6) is $956. This is calculated by taking the difference between the purchase price and the stock price ($115 – $106.63 = $8.37), adding the premium ( the graph uses the lower end of the range, so $1.19 + $8.37 = $9.56), and then multiplying the result by 100 ($9.56 x 100 = $956).

Strategies For Managing And Adjusting Covered Call Positions

Managing and adjusting positions is critical to implementing a successful covered call option strategy. While the strategy itself offers potential income generation and small downside protection, it is essential to actively monitor and adjust your positions to optimize returns and manage risk.

Here are some strategies for effectively managing and adjusting your covered call positions:

- Setting Realistic Profit Targets: Establish clear profit targets based on your risk tolerance and investment goals before entering a covered call position. Once the stock reaches your target price, consider closing the position to lock in profits. Otherwise, you can set the call’s strike price at your take-profit price.

- Regular Portfolio Monitoring: Monitor your portfolio regularly to identify any market conditions or stock performance changes that may impact your covered call positions. Stay updated with company news, earnings reports, or industry trends that could affect the underlying stock’s price.

- Rolling Options: As expiration dates approach, you may need to roll options by buying back the current option contract and selling another one with a later expiration date or higher strike price. This allows you to continue generating premium income while benefiting from further upside potential.

- Adjusting Strike Prices: If the underlying stock’s price rises significantly above the strike price of your short call option, you might consider adjusting the strike price by rolling up to capture additional premium or potentially close out the position entirely.

- Exiting Losing Positions: If a covered call position starts losing money due to significant declines in stock value, consider exiting the trade before it incurs further losses. By cutting losses early, you can preserve capital for more favorable opportunities.

- Diversification: Spreading out your covered call positions across different stocks from various industries can help reduce risk exposure while potentially increasing overall returns. Remember that managing and adjusting covered call positions requires active involvement and ongoing evaluation of market conditions.

Common Mistakes To Avoid When You Sell Covered Calls

The covered call option strategy can be an excellent way for beginners to generate income from their stock holdings. However, like any investment strategy, there are certain common mistakes that beginners should be aware of and avoid.

Firstly, one of the most significant mistakes beginners make is choosing the wrong stocks for the covered call strategy. It is crucial to select stocks that have good liquidity and moderate volatility. Avoid choosing highly volatile stocks or those with thinly traded options, as they may lead to unexpected losses or difficulties executing trades. Another mistake is not conducting thorough research before entering a covered call position.

Beginners often fail to analyze the underlying stock’s fundamentals, such as its financial health, industry trends, and prospects. Neglecting this essential step can result in holding stocks at risk of significant price declines or lack of substantial upside potential. Furthermore, another mistake many beginners make is not having an exit plan. Establishing clear guidelines for closing a position is essential if it becomes unprofitable or exceeds your desired profit target.

Without an exit plan, you may find yourself holding onto losing positions for too long or missing out on maximizing profits. Lastly, failing to properly manage risk is a critical mistake when engaging in covered calls. Beginners often overlook the importance of position sizing and setting stop-loss orders. By allocating too much capital to one trade or neglecting proper risk management techniques, you expose yourself to unnecessary risks and potential losses.

Conclusion: Building Wealth With The Covered Call Option Strategy

The covered call option strategy is an excellent tool for beginners seeking to build wealth in the stock market. This strategy allows investors to generate income from their existing stock holdings while partially offsetting downside risks. Individuals can capitalize on market volatility and maximize their returns by understanding the key principles and implementing a disciplined approach.

One of the major advantages of this strategy is its simplicity. With a basic understanding of options trading, investors can easily implement covered calls without extensive knowledge or experience. This makes it an ideal choice for beginners looking to dip their toes into options trading.

Furthermore, investors can generate regular income through premium payments by selling call options against their existing stock holdings. This additional income stream can significantly enhance overall portfolio returns and contribute to long-term wealth accumulation.

Another significant benefit of covered calls is the built-in downside protection they offer. By selling call options against stocks they already own, investors effectively create a cushion that helps mitigate some of the potential losses with the premium received if the stock price declines. However, this doesn’t eliminate all risks and certainly does not protect them from significant price drops.

Lastly, investors can optimize returns and adapt to evolving market dynamics by actively managing their covered call positions and adjusting them as market conditions change. Regular monitoring and adjustments allow individuals to capture profit opportunities while minimizing potential losses.

In conclusion, the covered call option strategy provides beginners an accessible approach to building wealth in the stock market. Individuals can leverage market volatility while safeguarding their investments by generating consistent income from existing stock holdings and managing risk through downside protection measures. With careful planning and execution, this strategy can potentially deliver long-term financial success for those willing to embrace its principles.