Selling put options is an investment strategy that can offer income for investors. It involves selling a contract that gives someone else the right to sell a specific stock at a predetermined price within a set time frame. It’s the reverse of selling a call option. Selling put options allows investors to generate income by collecting premiums in exchange for assuming the obligation to buy the underlying asset if it falls below the strike price.

While selling a put may sound complex, it can be an effective way for beginners to get into options trading. Individuals can benefit from this strategy by understanding the basics and employing proper risk management strategies.

One key advantage when you sell a put option is passive income generation. As an option seller, you receive premiums from buyers who want protection against potential losses in their stock holdings. This premium represents immediate income you get to keep, regardless of whether the option is exercised or not.

Understand the Risks of Selling Options

However, it’s important to note that selling put options also carries certain risks. If the underlying stock price drops significantly below the strike price, you may be obligated to purchase shares at a higher cost than their current market value. Therefore, thorough research and analysis are crucial before engaging in this strategy.

This guide on selling put options for beginners will explain various aspects of this investment technique. We will explore how it works, discuss different strategies for maximizing profits while minimizing risks, and provide practical tips on implementing these strategies successfully.

By understanding these fundamentals and applying them wisely in your investment decisions, you can begin your journey into selling put options confidently and potentially generate a second income.

Understanding Put Options And Their Mechanics

Put options are a type of financial derivative that allows investors to profit from a decline in the price of an underlying asset, such as stocks or commodities. As a beginner, it is crucial to understand the mechanics of put options before venturing into selling them.

The Role of the Put Option Seller

A put option is a contract between the buyer and the seller (also known as the writer). The buyer pays a premium to the seller in exchange for the right, but not the obligation, to sell an agreed-upon quantity of the underlying asset at a predetermined price (known as the strike price) within a specified period (known as the expiration date).

When selling put options, you take on the role of the seller. Doing so lets you collect premiums from buyers speculating that the underlying asset’s price will decrease. Suppose their prediction proves correct, and they exercise their option. In that case, the buyer will sell the underlying asset, and you are obligated to buy that asset at the strike price regardless of its current market value.

However, suppose the asset’s prices stay above the strike price, and the buyer does not exercise their option before expiration. In that case, you get to keep their premium without further obligations – and the option expires worthless.

The strike price is critical in determining profitability when selling put options. The primary goals of selling a put option is a) to potentially own the underlying stock at a future date and at a lower price than it is now and b) to generate income through premium payments from your short put contract.

It is important to note that selling put options carries risks. If prices plummet significantly below your chosen strike price and you are assigned shares for purchase at that higher cost than market value, it can result in substantial losses.

Benefits Of Selling Put Options For Beginners

Selling put options can be an excellent strategy for beginners looking to enter options trading. While it may initially seem intimidating, this approach offers several benefits worth considering.

First and foremost, selling put options allows beginners to generate income from their idle cash or margin from their existing portfolio. By selling puts, investors collect a premium upfront in exchange for taking on the obligation to buy the underlying stock at a predetermined price (the strike price) if it falls below that level by the expiration date.

Another advantage of selling put options is that it enables beginners to acquire stocks at potentially discounted prices. If the stock price drops below the strike price, the option seller must purchase shares at that strike price. A trader looking to buy a put option usually wants to profit off a short position and hopes for a drop in the stock price. Selling put options can benefit those with a more bullish outlook on this particular stock and are willing to hold it in their portfolio for the long term.

Theta is Your Friend

Additionally, selling put options allows beginners to benefit from time decay or theta decay. As time passes, the value of an option decreases due to diminishing time until expiration. By selling puts with short-term expirations and collecting premiums repeatedly, beginners can take advantage of this time decay effect and potentially earn consistent profits.

Evaluating Stocks For Selling Put Options

When it comes to selling put options, one of the key steps is evaluating the stocks you are considering. This evaluation process is crucial to ensure that you make informed decisions and maximize your chances of success. Here are some factors to consider when evaluating stocks for selling put options:

Fundamental Analysis

Start by conducting a thorough fundamental analysis of the stock. Look at the company’s financial health, earnings growth, revenue trends, and competitive position in the industry. These factors will help you understand whether the stock has a solid foundation and potential for future growth.

Traders can use websites such as Barchart.com to conduct their analyses. Barchart also offers technical analysis tools, analyst reviews, the latest news and announcements, and other helpful information about chosen stocks and companies.

Market Trends

Consider the overall market trends and sentiment towards the stock. Is it a sector that is currently performing well? Are there any external factors that could impact its performance? Understanding market conditions can help you gauge whether there is a demand for the stock or if it may face challenges.

Volatility

Evaluate the historical volatility of the stock. Higher volatility can result in higher premiums when selling put options but also carries increased risk. Analyze price movements over time and assess whether they are within your risk tolerance.

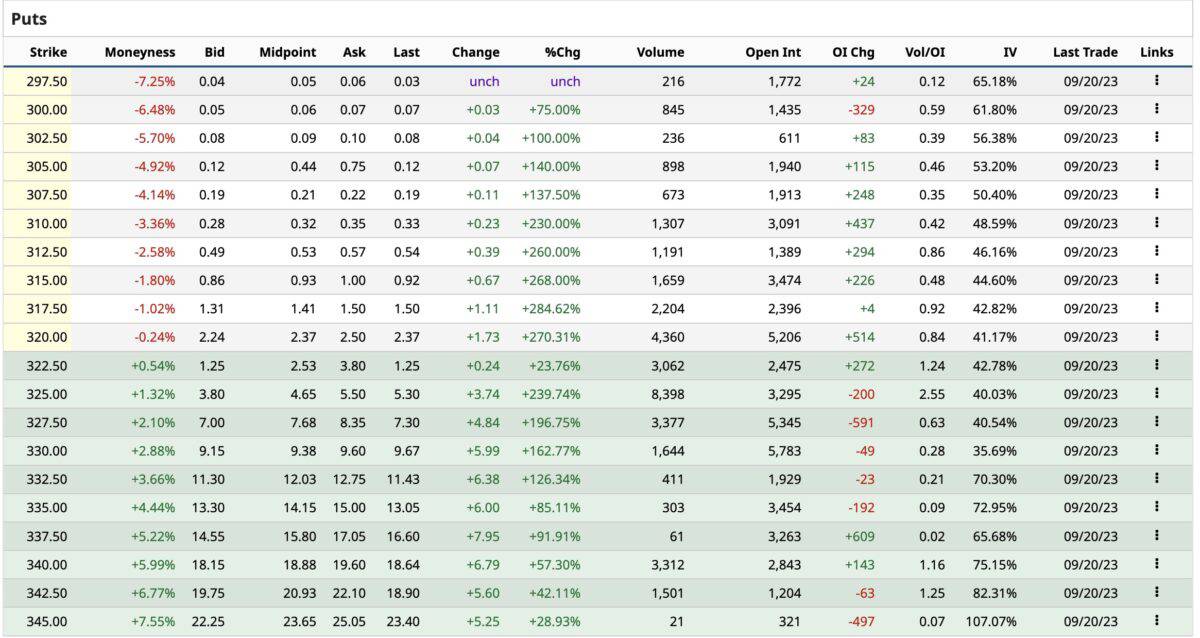

Option Chain Analysis

Reviewing the option chain can provide valuable insights into market expectations and sentiment toward a particular stock option. Pay attention to open interest, volume, bid-ask spreads, and strike prices available at your desired entry point.

Risk Management

Determine your risk tolerance level before selecting stocks for selling put options. Consider how much capital you are willing to allocate per trade and set guidelines for maximum loss limits or portfolio exposure.

Setting The Strike Price And Expiration Date

When it comes to selling put options as a beginner, two critical factors are the strike price and expiration date. These elements are crucial in determining your options trade’s potential profitability and risk.

The strike price refers to the predetermined price at which the underlying asset can be bought from you if the buyer exercises the put option. Choosing an appropriate strike price that aligns with your trading strategy and outlook on the underlying stock or index is essential.

As a beginner, selecting a strike price well below the underlying asset’s current market price is generally recommended. This approach allows you to generate income upfront while providing downside protection if the stock’s value declines. Setting a higher strike price increases your chances of being assigned (forced to sell shares) but also enhances potential profits.

Another factor that influences an options contract’s value is its expiration date. This date represents when the contract expires and becomes void if not exercised before. Choosing an appropriate expiration date depends on several factors, including your trading objectives, market conditions, and time horizon.

As a beginner, opting for longer expiration dates when selling put options may be prudent. Longer expirations provide more time for your trade thesis to play out and reduce short-term market volatility risks. Additionally, they allow you more opportunities for adjustment or closing positions before expiration should market conditions change.

Longer-dated options contracts also typically offer higher premiums due to their increased time value. Therefore, balancing premium income generation and desired exposure duration is crucial when selecting an expiration date.

Calculating Potential Profits And Risks In Selling Put Options

The premium received represents the seller’s potential profit, but it also comes with risks that must be carefully assessed. To calculate potential profits, one must consider whether the option is exercised and if it expires worthless. If the option is exercised, meaning the stock’s price falls below the strike price before expiration, the seller must purchase shares at that predetermined strike price.

If the option is exercised, your P&L is calculated by subtracting the strike price from the current market price minus any transaction costs or fees. Conversely, if the option expires worthless because its value remains above or equal to its strike price until expiration, no shares need to be bought. In this scenario, potential profits are equal to the premium received from selling the put option.

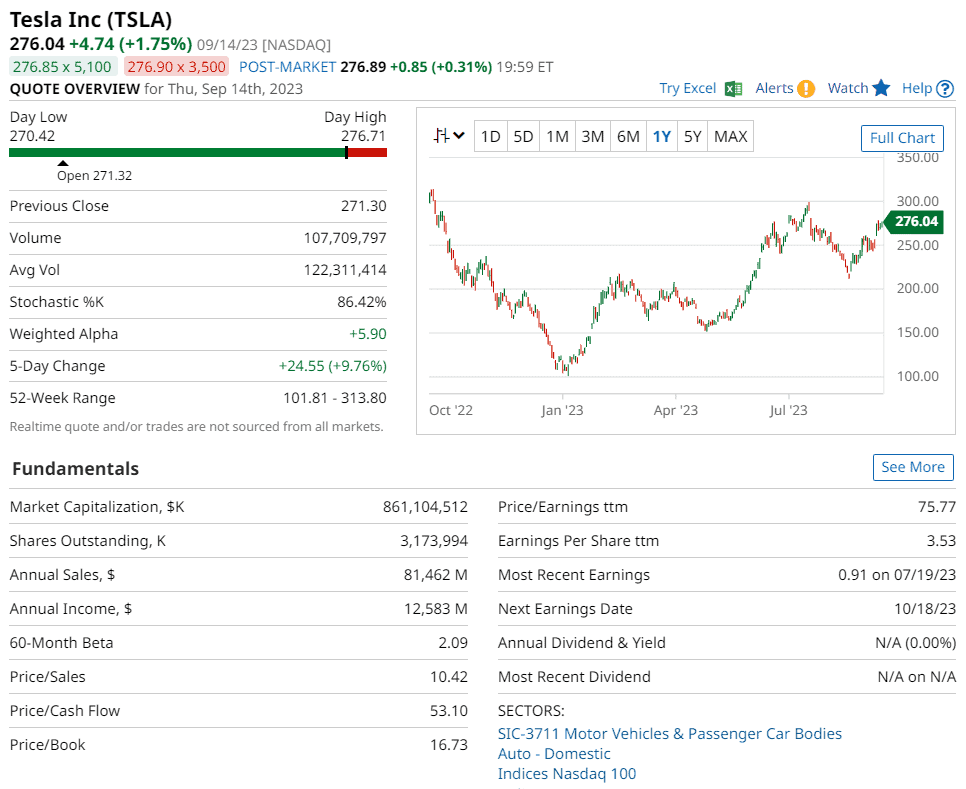

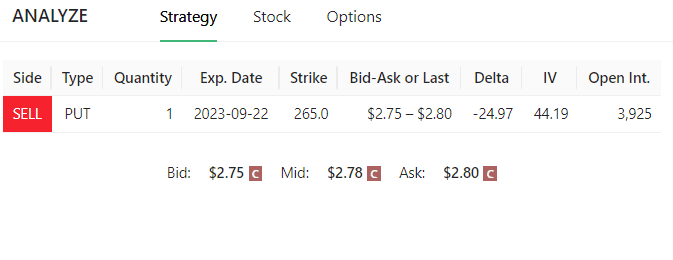

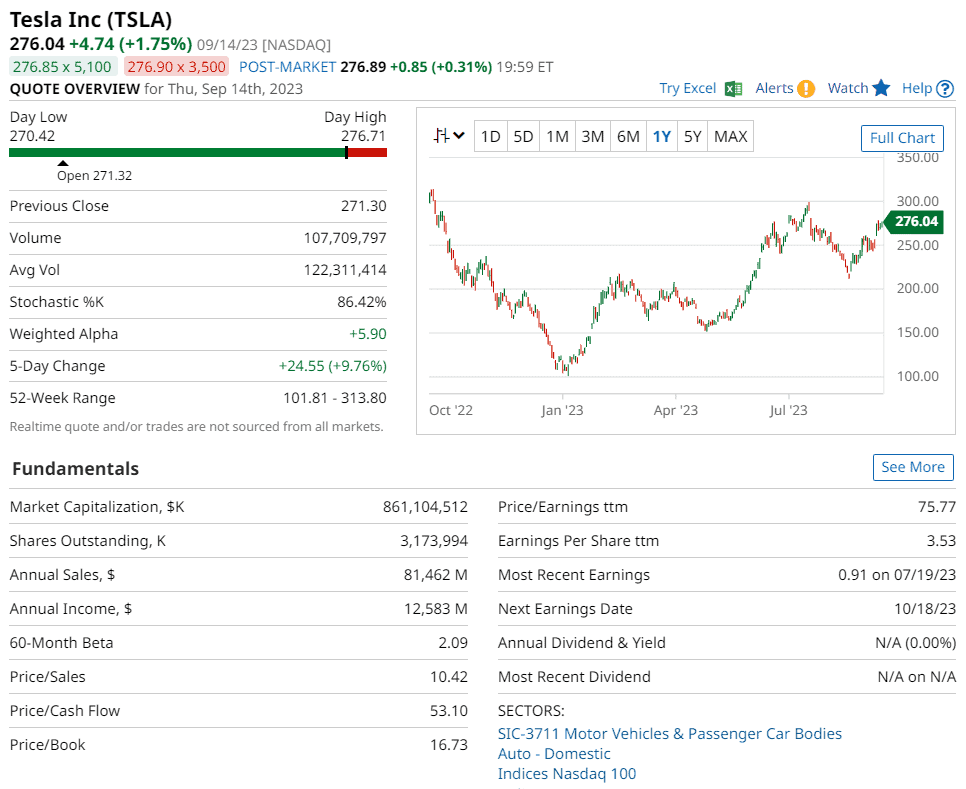

Using real-world examples, we use an options scanner to illustrate best how a put option trade can develop. Let us take a look at Tesla Inc. (TSLA), which is currently trading at $276.04.

Let’s say the trader wants to write a put with a $265 strike price expiring on September 22 for a premium between $2.75 – $2.80.

In the Money (ITM)

As TSLA trades at $276.04, and our strike price is $265, this option is out-of-the-money. Buyers of put options want the stock price to drop below the strike price so they can profit from the difference. So, if TSLA drops to $250 at expiration, the buyer will exercise the option and sell the stock at $265. The put seller (writer) must buy 100 shares of stock (times the number of contracts) at that price, resulting in an unrealized loss of $15 per share. This loss is slightly offset by the premium they earned for selling the put.

Out of the Money (OTM)

Should TSLA’s price stay above $265, the put will expire worthless or out of the money. All obligations are lifted, and the writer gets to keep the premium paid by the buyer.

Profit/Loss Profile

Option scanners like Option Samurai provide traders detailed information and scenarios for different stocks and options strategies. The platform can scan over 1.2 million ETFs and stocks to get you the most appropriate options for your preferred strategy.

We’ll use Option Samurai for the TSLA puts and check the P/L Profile. The X-axis plots the TSLA’s price, and the Y-axis shows the potential profits or losses.

Again, the maximum profit for selling put options is capped at the premium received for the contract. This chart plots the maximum profit using the $2.75 premium paid per share, which means the trader will earn $275 if the option expires out of the money.

Now, let’s take a look at the potential losses. As we can see, the loss sharply decreases with the stock price’s drop, reaching about $2,750 total at the end of the graph, around the lower end of the $230 stock price. As profits are capped at $275, the losses look disproportionate. This is why selling puts can be considered a moderately risky strategy.

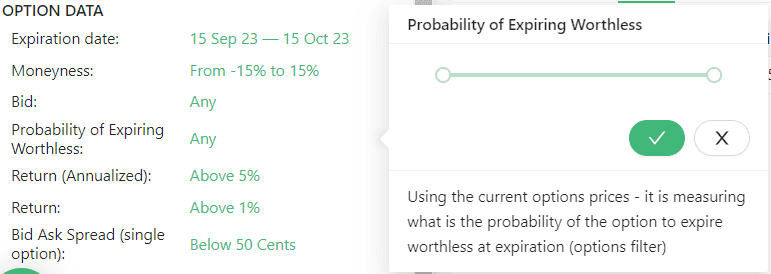

How to Increase the Probability of Put Options Expiring Worthless

Options strategies that profit solely from premium payments need contracts to expire out of the money or worthless to avoid assignment. Option Samurai has a useful filter that ranks an option strategy’s probability of expiring worthless, giving newbie put sellers an idea of their chosen trade’s probability of success. This can help put sellers have a higher chance of selling contracts that will expire worthless.

Traders can use the sliders from either end of the Probability of Expiring Worthless filter to define the range, expressed in percentages.

Implementing Risk Management Strategies In Selling Put Options

As a beginner, it is crucial to implement effective risk management strategies to protect your investment and minimize potential losses. While this trading strategy can be profitable, it has risks. By incorporating risk management techniques, you can enhance your chances of success and safeguard your portfolio.

Set a Clear Exit Plan

One key risk management strategy is setting a clear exit plan before entering a trade. This involves determining the maximum loss you will accept on any trade and implementing stop-loss orders accordingly. Stop-loss orders automatically trigger the sale of the put option if it reaches a specific price point, limiting potential losses. Establishing predetermined exit points can prevent emotions from clouding your judgment and ensure that losses are within acceptable limits.

Diversify

Another essential aspect of risk management in selling put options is diversification. Spreading your investment across different underlying assets can help reduce exposure to individual stock or market risks. By diversifying your portfolio, you can offset potential losses from one position with gains from others, ultimately minimizing the impact of any single trade on your overall portfolio performance.

Don’t Set it and Forget!

Additionally, monitoring market conditions and staying informed about relevant news or events is crucial for managing risks effectively. Market volatility and unexpected developments can significantly impact option prices and result in substantial losses if not anticipated or addressed promptly. Stay updated with company earnings reports, economic indicators, and industry trends to make informed decisions when selling put options.

Lastly, continuously assessing and adjusting your risk tolerance based on personal circumstances is vital for successful options trading. As a beginner, it may be prudent to start with smaller positions until you become more comfortable with the strategy’s intricacies and fluctuations in the market.

By implementing these risk management strategies in selling put options as a beginner trader, you can protect yourself against excessive losses while maximizing the profit potential of this trading strategy. Remember that proper risk management goes hand-in-hand with disciplined decision-making and continuous learning to achieve long-term success in options trading.

Monitoring And Adjusting Your Positions In Selling Put Options

Once you have sold put options, monitoring and adjusting your positions is crucial. This will help you stay on top of market trends and make informed decisions to maximize your profits and minimize potential losses.

One of the primary things to monitor is the stock’s price moves. Keep an eye on how the underlying stock is performing relative to the strike price of the option you have sold. If the stock price remains above or at the strike price until expiration, you can retain the premium received when selling the put option. However, if the stock price drops below the strike price, you may need to consider adjusting your position.

If the stock’s price falls significantly below the strike price, you may face assignment, meaning that you will be obligated to purchase shares of the underlying stock at a higher cost than its current market value. To avoid this situation, you can buy back or close out your position by buying back the put option before expiration. By doing so, you can limit your potential losses and free up capital for other trading opportunities. That said, the option will be more expensive than when you sold it – resulting in a loss.

Adjusting Your Position for Loss Mitigation

One way to mitigate the loss is rolling out or down your put options.

Rolling out involves closing your current position before expiration and selling a new one with a later expiration date but at a similar strike price. This strategy allows you to collect additional premiums while extending your time horizon.

On the other hand, rolling down involves closing out your current position at a particular strike price and simultaneously selling a new put option with a lower strike price but with an equivalent or later expiration date. Rolling down allows you to reduce potential losses if there is an expectation that the stock’s downward momentum may continue.

Whichever way you choose to adjust, you’ll collect income from selling the new put option which will offset any losses from the original trade.

Final Thoughts on Building a Successful Strategy Selling Put Options

Put selling can be an effective strategy for generating income and potentially acquiring stocks at a lower price. However, beginners must approach this strategy cautiously and develop a well-thought-out plan.

Remember that selling put options involves risks, including potential losses, if the stock’s price falls significantly below the strike price. It is essential for beginners to thoroughly educate themselves about option trading strategies before diving into this complex area of investing.

By developing a disciplined approach, beginners can build a successful strategy and generate income selling options. With time and experience, you can refine your skills and potentially achieve consistent profits while managing risk effectively.