Introduction To The Iron Butterfly Strategy

Strategies that offer stability and limited risk are highly sought after volatility and uncertainty can send shivers down the spine of even experienced traders. One such strategy that has gained popularity among seasoned investors is the iron butterfly strategy.

The iron butterfly strategy is a neutral options trading strategy that aims to profit from minimal price movement in an underlying asset. It is often employed when a trader anticipates low volatility in the market or expects the price of an asset to remain stagnant within a specific range.

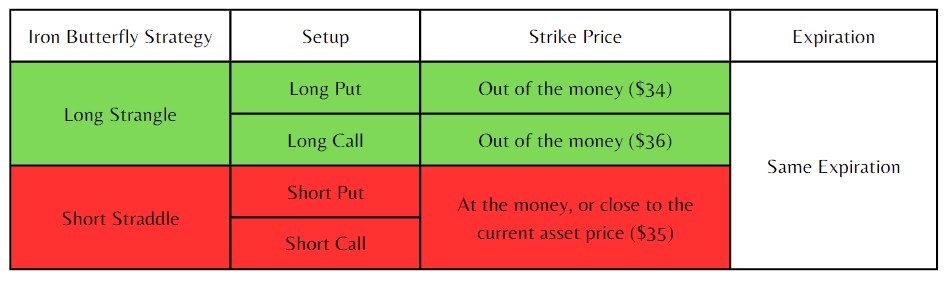

This versatile strategy involves combining two different options trades: a short straddle and a long strangle. The short straddle entails simultaneously selling both a call option and a put option at the same strike price, while the long strangle involves purchasing both a call option and a put option at different strike prices. By combining these two trades, traders can create an iron butterfly position.

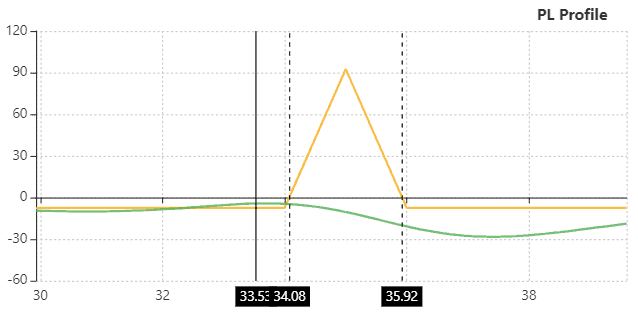

The iron butterfly gets its name from its visual representation on an options chain graph, which resembles a butterfly’s wings. The body of this “butterfly” represents profit potential, while its wings symbolize limited risk.

When implementing this strategy, traders hope for minimal movement in the underlying asset’s price during their desired timeframe. If this occurs, they can pocket maximum profits at expiration as both sides of their position expire worthless. However, losses may be incurred if significant price movement occurs beyond certain thresholds called breakeven points.

As we delve deeper into understanding this sophisticated trading technique, we will explore its mechanics and examine various scenarios to fully grasp how it functions under different market conditions. So buckle up as we unravel the complexities of the iron butterfly strategy!

Understanding The Basics: What Is The Iron Butterfly Strategy?

The iron butterfly’s unique combination allows traders to profit from a neutral market outlook, where they expect limited volatility and minimal price movement in the underlying asset.

To understand this strategy, let’s break it down. First, we have the short straddle, which involves selling a call option and a put option with the same strike price and expiration date. By doing so, traders collect premium income from both options sold. The idea behind this strategy is that if the stock price remains stagnant or within a specific range until expiration, both options will expire worthless, allowing traders to keep the premium collected.

On the other hand, we have the long strangle component of this strategy. This involves buying an out-of-the-money call option and an out-of-the-money put option with different strike prices but the same expiration date. This part of the strategy aims to protect against extreme moves in either direction by providing insurance.

By combining these two strategies into an iron butterfly position, traders aim to profit from time decay while limiting potential losses due to unexpected market movements.

The iron butterfly position has a limited risk-reward profile. If, at expiration, stock price remains within a specific range known as “the wings” – defined by strike prices of both call and put options sold – maximum profit is achieved. However, losses can be significant if the stock price moves beyond these wings in either direction at expiration.

Key Components Of The Iron Butterfly Strategy

The iron butterfly involves selling both a call and a put option at the same strike price and buying a call and a put option at different strike prices. This creates a unique combination of options that can result in profits when the underlying asset remains within a specific range.

One of the key components of the Iron Butterfly strategy is its symmetry. The strategy is designed to have equal risk and reward on both sides, making it neutral regarding market direction. This means that traders using this strategy are not betting on whether the market will go up or down; rather, they are betting on low volatility and price stability.

Another critical component of this strategy is selecting the right strike prices for each option. The call and put options sold should be at-the-money (ATM), meaning their strike price should be close to the underlying asset’s current price. This ensures that if the price remains within a certain range, both options will expire worthless, resulting in maximum profit.

The strike prices for the bought call and put options are usually chosen based on how far away they are from the ATM options. These out-of-the-money (OTM) options protect large moves in either direction, limiting potential losses.

Risk management is also crucial when implementing an Iron Butterfly strategy. Traders need to consider their risk tolerance and set stop-loss orders accordingly to protect against unexpected market movements.

Understanding these key components – symmetry, strike price selection, and risk management – is essential for successfully implementing an Iron Butterfly strategy. By carefully considering these factors and monitoring market conditions closely, traders can potentially generate consistent profits when volatility is low.

Step-By-Step Guide: How To Implement The Iron Butterfly Strategy

1. Identify an underlying stock or index: Begin by selecting an underlying asset that you believe will remain relatively stable over the duration of your options trades. It’s crucial to choose assets with low volatility for this strategy.

2. Determine the target price range: Analyze historical price data, technical indicators, and market trends to identify a narrow price range in which you expect the underlying asset to trade until expiration.

3. Select strike prices: Choose strike prices for your options contracts based on your target price range. Sell a call and put option at the same strike price, typically at the money (ATM), while buying one call option above the current stock price and one below it.

4. Decide on expiration date: Consider your timeframe for this trade and select an expiration date that aligns with your expectations for when the stock or index will remain within your target range.

5. Execute trade: Place orders to sell one call and one put option at the chosen strike price while simultaneously buying one call option above and below it.

6. Monitor position: Keep track of how the underlying asset moves throughout its trading period, ensuring it stays within your targeted range as predicted.

7. Manage risk: Regularly assess your position’s performance against market conditions.

Consider adjusting or closing out positions if they deviate significantly from your expected outcome or if expiration approaches.

Analyzing Profit Potential And Risk Management In The Iron Butterfly Strategy

The iron butterfly strategy is a popular options trading strategy that combines long and short option positions to create a neutral market outlook. Traders utilize this strategy when they expect the underlying asset’s price to remain within a specific range over a period.

To analyze the profit potential of an iron butterfly strategy, it is crucial to understand its components. This strategy consists of four options contracts: two at-the-money (ATM) call options, two ATM put options, and all options having the same expiration date. By simultaneously selling out-of-the-money (OTM) call and put options while buying further OTM call and put options, traders aim to profit from time decay while limiting their risk exposure.

The maximum profit potential in an iron butterfly trade occurs when the underlying asset’s price remains within the range defined by the strike prices of the sold call and put options at expiration. All four options expire worthless, resulting in the trader keeping both premiums received for selling them.

However, it is important to consider risk management when utilizing this strategy. The risk in an iron butterfly trade arises from extreme movements in either direction beyond the strike prices of the bought call or put options. If such movements occur before expiration, losses can accumulate rapidly.

To manage risk effectively, traders must set appropriate stop-loss orders or have predetermined exit points. Additionally, monitoring market conditions closely is crucial as unexpected events or news can lead to significant price movements that may impact profitability.

Exploring Examples: Real-Life Applications Of The Iron Butterfly Strategy

Companies often experience increased stock price volatility during earnings announcements, making it an opportune time for options traders. By implementing an iron butterfly, traders can take advantage of the expected decrease in implied volatility post-earnings while limiting their potential losses. Another real-life application of the iron butterfly strategy is during periods of low market volatility. When markets are relatively stable, options premiums tend to decrease due to lower implied volatility levels.

Traders can utilize this opportunity by setting up an iron butterfly position, profiting from the premium collected while limiting risk. Furthermore, investors often employ the iron butterfly strategy when anticipating a range-bound market scenario. In such situations, where they expect minimal price movement within a specific range, this strategy allows them to capitalize on time decay and collect option premiums.

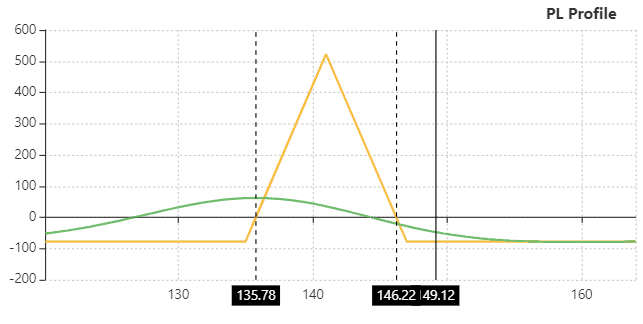

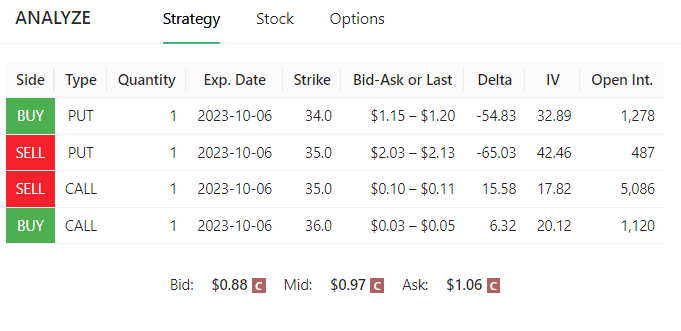

Now, let’s take a look at how the iron butterfly strategy can be applied in real-world trading. For this example, we’ll look at Verizon (VZ), which Barchart.com tells us is trading at $33.53. The iron butterfly strategy can be used here if the trader believes that VZ’s stock prices will remain relatively stable, perhaps between $34 and $36 in the short term.

So, let’s start with the strategy by considering Option Samurai’s suggestions.

The fastest way to describe an iron butterfly spread is it’s a combination of a long strangle (long put + long call, different strike, same expiration) and a short straddle (short put + short call, same strike price, same expiration). Alternatively, it can also be a combination of a bear call spread and a bull put spread.

Now let’s look at different scenarios:

Breakeven

The iron butterfly can incur losses when the price moves in either direction. As such, there are two breakeven prices, which are near the long strangle’s (or long call and put’s) strike prices.

Profit

The maximum profit for this trade can be achieved if the price of the underlying ends at $35 on expiration, which is the short straddle’s strike price. We got this value with the assumption that the trader was able to purchase and sell options at the lower end of the indicated strike price range ($1.15 and $0.03 / $2.03 and $0.10, respectively). Here’s how we compute the max profit:

Premium paid for long strangle: $1.15 + $0.03 = $1.18

Premium received for short straddle: $2.03 + $0.10 = $2.13

Total profit: $2.13 – $1.18 = $0.95 x 100 shares = $95

Loss

The maximum loss of the iron butterfly is limited to the distance from the short straddle’s strike price to any of the long strangle’s legs, less the premium received. In this case, the difference between strike prices is $1 minus $.95 x 100 = $50.

Common Mistakes To Avoid When Using The Iron Butterfly Strategy

One common mistake is failing to properly analyze the underlying stock or index before implementing the iron butterfly strategy. It is essential to carefully assess market conditions and identify stocks or indices that are likely to remain within a specific price range. Without conducting thorough research, you may end up implementing an iron butterfly on an underlying security that moves outside your desired range, resulting in losses.

Another mistake to avoid is not considering the impact of volatility on your iron butterfly trade. Volatility plays a crucial role in options pricing, and failing to account for it can lead to unexpected outcomes. High volatility can increase option premiums, making it more expensive to establish an iron butterfly position. Conversely, low volatility may reduce potential profits or limit your ability to exit the trade at desired prices.

Additionally, many traders make the mistake of neglecting risk management when employing the iron butterfly strategy. It is vital to determine appropriate stop-loss levels and profit targets before entering any trade. Failing to set these parameters can expose you to significant losses or prevent you from capitalizing on potential gains. Lastly, emotional decision-making often leads traders astray when using this strategy.

Impulsive actions driven by fear or greed can disrupt your trading plan and result in poor decision-making. Sticking with a well-thought-out plan based on careful analysis and logical reasoning will increase your chances of success with the iron butterfly strategy. In conclusion, avoiding common mistakes associated with the iron butterfly strategy is crucial for achieving consistent profitability in options trading.

Advanced Techniques: Fine-Tuning Your Iron Butterfly Strategy

Once you have grasped the basics of the iron butterfly strategy, it is time to delve into advanced techniques that can help fine-tune your approach. By incorporating these techniques, you can enhance your chances of achieving maximum profitability and minimizing potential risks.

1. Strike Price Selection: Careful consideration of strike prices is crucial for a successful iron butterfly strategy. Opt for strike prices that are close to the current market price but offer a favorable risk-reward ratio. This ensures that the underlying asset remains within the profit zone during expiration.

2. Implied Volatility Analysis: Monitoring implied volatility levels is essential for an iron butterfly strategy. Higher implied volatility increases option premiums and enhances potential profits while also increasing risks. Analyzing historical volatility trends and comparing them with implied volatility levels can assist in making informed decisions.

3. Time Decay Management: As time passes, options lose their value due to time decay. To maximize profits, it is vital to monitor and manage this aspect effectively by closing positions at appropriate times or rolling them over to future expiration dates when necessary.

4. Adjusting Position Size: Properly adjusting position sizes based on market conditions and risk tolerance is crucial in managing an iron butterfly strategy effectively. Smaller position sizes reduce potential losses while allowing for increased flexibility in adjusting trades as needed.

5. Exit Strategy Planning: Developing a well-defined exit strategy is paramount in any trading approach, including an iron butterfly strategy. Determine specific profit targets or loss thresholds before entering trades, enabling you to exit positions at predetermined levels without succumbing to emotional decision-making.

6. Risk Management Techniques: Implementing risk management techniques such as stop-loss orders or hedging strategies can be beneficial when executing an iron butterfly strategy.

These tools help limit potential losses in case of unexpected market movements.

Comparing The Iron Butterfly Options Strategy With Other Options Trading Strategies

When comparing the Iron Butterfly strategy with other options trading strategies, it is important to consider factors such as risk-reward ratio, profit potential, and market conditions. One key advantage of the Iron Butterfly strategy is its limited risk exposure. Unlike other strategies involving naked options or unlimited potential losses, the Iron Butterfly has a predefined maximum loss.

Another benefit of this strategy is its versatility in different market conditions. While some strategies are more suitable for trending markets or high volatility scenarios, the Iron Butterfly can be effective in both trending and ranging markets. This adaptability allows traders to potentially profit regardless of whether the market is moving up, down, or sideways.

In terms of profit potential, the Iron Butterfly has a capped maximum profit, like the iron condor spread. This means that while it offers limited risk exposure, it also limits potential gains compared to certain directional strategies like long calls or puts. However, it should be noted that achieving maximum profit with this strategy requires precise timing and accurate predictions regarding future price movements.

Compared to other neutral options trading strategies, such as straddles or strangles, which also aim to benefit from low volatility periods, the Iron Butterfly offers a more balanced risk-reward profile. The combination of selling both call and put options helps offset some potential losses if there is a significant move in either direction.

Overall, when comparing various options trading strategies including directional or neutral approaches, it becomes clear that the Iron Butterfly strategy provides an attractive balance between risk management and profit potential in periods of low volatility.

Conclusion: Is The Iron Butterfly Strategy Right For You?

In conclusion, the Iron Butterfly strategy is a versatile and effective options trading strategy that can be employed in various market conditions. It offers traders the opportunity to profit from range-bound markets while limiting their risk exposure. However, before deciding if this strategy is suitable for you, it is crucial to consider a few key factors.

Firstly, the Iron Butterfly strategy requires a deep understanding of options trading and the associated risks. It involves multiple legs and strike prices, which can be complex for novice traders. Therefore, it is recommended that individuals have a solid foundation in options trading before attempting to implement this strategy.

Secondly, the Iron Butterfly strategy may not be ideal for those seeking substantial returns or quick profits. This approach is primarily designed to generate income through collecting premiums from option contracts. While it can provide consistent profits in range-bound markets, it may not deliver significant gains during periods of high volatility or strong directional movements.

Additionally, traders should carefully assess their risk tolerance when considering the Iron Butterfly strategy. Although this approach limits potential losses by using both call and put options simultaneously, there is still a risk of losing the premium paid if the underlying asset moves significantly beyond the breakeven points.

Lastly, successful implementation of the Iron Butterfly strategy requires diligent monitoring and adjustment as market conditions change. Traders must be proactive in managing their positions and have access to real-time market data to make informed decisions.