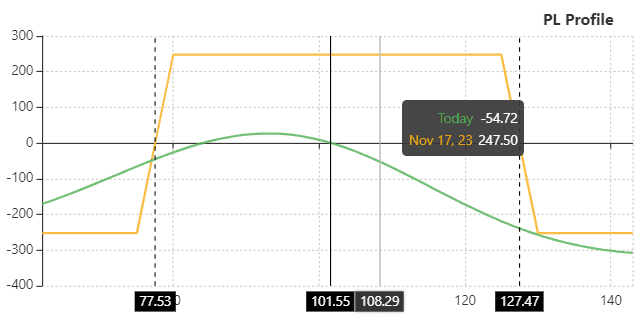

Terminology Reference Sheet

What Is The Iron Condor Options Strategy?

The iron condor is a popular advanced trading strategy employed by options traders to generate income while limiting potential losses. It involves simultaneously selling both a call spread and a put spread on the same underlying asset, typically with the same expiration date. This strategy aims to capitalize on low volatility and sideways market conditions, where the underlying asset’s price remains within a specific range.

Let’s break down its components to understand how an iron condor works. Firstly, a call spread consists of selling one out-of-the-money (OTM) call option while simultaneously buying another OTM call option with a higher strike price. The next step involves selling an OTM put option and buying another OTM put option with a lower strike price to establish a limited-profit bullish position.

By combining these two spreads into one iron condor trade, traders create a neutral market position that benefits from time decay or decreases in implied volatility without requiring the underlying asset’s price to move significantly in either direction.

The profit potential of an iron condor is defined by the difference between the premiums received from selling the spreads, and the maximum loss potential occurs when either side of the trade is breached. Traders typically choose strike prices for both spreads equidistant from the current market price to maximize profitability while minimizing risk.

How To Construct An Iron Condor Spread

Constructing an iron condor spread involves four main steps: selecting the underlying asset, determining the strike prices, choosing the expiration date, and calculating potential profit and loss.

The first step is to select an underlying asset that you believe will remain range-bound within a specific price range until expiration. It is crucial to choose a highly liquid asset with trading options contracts available for trading, such as stocks or indices.

Next, determine the strike prices for both call and put options. The strike prices should be selected based on your desired profit potential and risk tolerance. The higher strike price for the call option should be above the expected upper limit of the range, while the lower strike price for the put option should be below the expected lower limit of the range.

After selecting the strike prices, choosing an expiration date that aligns with your trading goals is essential. Shorter-term options offer quicker potential profits but increase risk due to higher time decay. Longer-term options provide more time for market fluctuations but may require more significant capital commitments.

Once you have selected all these parameters, you can calculate your maximum profit and risk by considering both premiums received and paid. To calculate maximum profit, subtract the net premium received from the width between each strike price. On the other hand, the maximum loss is determined by adding or subtracting (depending on whether it’s a credit or debit spread) the net premium received or paid from one of the spreads’ widths.

It is important to note that constructing an iron condor spread requires careful consideration of these factors as they determine potential returns and risks involved in this strategy. As with any investment strategy involving options trading, proper risk management techniques should always be implemented to protect against unexpected market movements.

Understanding The Risk-Reward Profile Of An Iron Condor

The iron condor option strategy is a popular choice among experienced traders looking to generate income and manage risk simultaneously. It involves the simultaneous use of two credit spreads, typically combining a bear call spread and a bull put spread. While this strategy offers potential profits, it also carries its own risks that traders must fully comprehend before implementing.

The risk-reward profile of an iron condor is defined by the maximum profit and maximum loss achievable. The potential profit is limited to the net credit received when initiating the trade, while the maximum loss is capped at the difference between the spreads’ strike prices minus the net credit received.

By utilizing both call and put options simultaneously, an iron condor aims to benefit from a non-directional market assumption. This means that traders expect the underlying asset’s price to remain within a specific range until expiration. The goal is for all options in this strategy to expire worthless, allowing traders to keep the initial premium collected as profit.

However, there are inherent risks associated with this strategy. Losses can occur if one or both sides of the iron condor are breached due to significant price movements in either direction. This could happen if the underlying asset’s price exceeds one of the breakeven points established by each spread.

Furthermore, time decay is crucial to an iron condor’s profitability. As expiration approaches, options lose value due to diminishing time value. However, losses may outweigh any remaining time decay benefits if substantial price movements are close to expiration.

It is essential for traders implementing this strategy to monitor their positions closely and have contingency plans in place should unexpected market events occur. Depending on market conditions, adjustments such as rolling up or down spreads or closing out positions may be necessary.

Step-By-Step Guide To Trading Iron Condors

Iron condor is a popular options trading strategy that allows traders to profit from a range-bound market. It involves simultaneous selling an out-of-the-money (OTM) call spread and an OTM put spread on the same underlying asset with the same expiration date. This strategy is designed to generate income while limiting potential losses. Here is a step-by-step guide to trading iron condors:

1. Identify a suitable underlying asset: Look for stocks, indices, or ETFs with low volatility and are likely to remain within a certain price range for the duration of the trade.

2. Determine the expiration date: Choose an expiration date that gives enough time for the trade to work out but not too far in the future that time decay becomes significant.

3. Establish position size: Calculate how much capital you are willing to allocate to this trade and determine your position size accordingly. This will depend on your risk tolerance and account size.

4. Select strike prices: Choose strike prices for both call and put spreads that are equidistant from the underlying asset’s current price, ensuring that they are far enough away from it so as not to be breached during the trade.

5. Sell OTM call spread: Sell one call option at a higher strike price and simultaneously buy another call option at an even higher strike price, creating a credit spread.

6. Sell OTM put spread: Sell one put option at a lower strike price and simultaneously buy another put option at an even lower strike price, creating another credit spread.

7. Monitor your positions: Keep track of how your iron condor is performing throughout its duration by monitoring changes in stock prices, implied volatility levels, and time decay effects on options premiums. 8. Manage risk: Set stop-loss orders or predetermined exit points in case the market moves against your iron condor position beyond acceptable levels. 9. Close the position: Ideally, close the position before expiration to lock in profits or minimize potential losses.

Key Components Of An Iron Condor Trade

The iron condor option strategy is popular among experienced options traders due to its potential for limited risk and consistent profit. To successfully execute an iron condor trade, it is essential to understand its key components and how they work together.

1. Call Credit Spread: The first component of an iron condor trade involves selling a call credit spread.

This means selling a call option with a higher strike price while simultaneously buying a call option with an even higher strike price. The goal here is for the underlying asset’s price to remain below the sold call option’s strike price at expiration, allowing both options in the spread to expire worthless.

2. Put Credit Spread: The second component is selling a put credit spread. Similar to the call credit spread, this involves selling a put option with a lower strike price and buying another put option with an even lower strike price. In this case, the objective is for the underlying asset’s price to stay above the sold put option’s strike price at expiration, resulting in both options expiring worthless.

3. Limited Risk: One key feature of an iron condor trade is its limited risk compared to other options strategies. By combining two credit spreads (call and put), traders define their maximum potential loss upfront if the underlying asset’s price moves beyond the spread’s breakeven points.

4. Profit Potential: The profit potential of an iron condor trade lies in capitalizing on time decay (theta) as well as implied volatility contraction after placing the trade. As long as the underlying asset remains within a specific range between the two spreads’ strikes at expiration, traders can achieve their maximum profit when all four options expire worthless.

5. Adjustments and Risk Management: Monitoring and adjusting iron condor trades are crucial components of managing risk effectively. Traders may choose to roll out or adjust one side of the position if they anticipate a potential breach of the spreads’ breakeven points. Understanding these key components is essential for successfully executing an iron condor trade.

Managing Potential Losses In An Iron Condor Strategy

While the iron condor option strategy offers a limited risk and profit potential, it is crucial for traders to understand how to manage potential losses effectively. Like any investment strategy, losses are possible, and having a plan in place to minimize them is essential.

One way to manage potential losses in an iron condor strategy is through stop-loss orders. A stop-loss order allows traders to set a predetermined price at which they are willing to exit the trade if it moves against them. Traders can limit their potential losses by placing a stop-loss order below or above the breakeven points of the iron condor spread.

Another approach for managing potential losses is adjusting the position as market conditions change. This can be done by rolling out or up/down the options within the iron condor spread. Rolling out involves closing the current position and simultaneously opening a new one with later expiration dates. Rolling up or down refers to adjusting strike prices within the same expiration cycle.

These adjustments allow traders to extend their timeframe or widen their profit range, potentially reducing losses.

It is also crucial for traders to monitor their positions closely and stay updated on market trends and news that may affect their iron condor strategy. By staying informed, they can make timely decisions regarding adjustments or even exit the trade altogether if necessary.

Furthermore, proper position sizing and risk management techniques can help manage potential losses effectively. Traders should avoid allocating too much capital into a single iron condor trade and diversify their portfolios accordingly.

Lastly, it is essential not to let emotions dictate trading decisions when managing potential losses in an iron condor strategy. Fear or greed can lead traders astray from their original plan, causing them to hold on too long or exit prematurely.

In conclusion, managing potential losses in an iron condor option strategy requires careful planning and adherence to risk management principles. By utilizing stop-loss orders, adjusting positions, staying informed, practicing proper position sizing, and controlling emotions, traders can effectively mitigate potential losses and increase their chances of success with this strategy.

Advantages And Disadvantages Of Using Iron Condors

The iron condor option strategy is popular among seasoned options traders due to its potential to generate consistent income while managing risk. However, like any trading strategy, it has advantages and disadvantages that should be carefully considered before implementation. One of the key advantages of using iron condors is the ability to profit from a range-bound market. This strategy is designed for situations with limited volatility, as it involves selling both a call spread and a put spread with out-of-the-money strikes.

As long as the underlying asset remains within this range until expiration, the trader can potentially capture the premium received from selling these spreads. Another advantage of iron condors is their defined risk and reward. Since this strategy involves simultaneously buying and selling options, the potential losses are limited to the difference between the strikes of the spreads minus the premium received.

This capped risk allows traders to have better control over their potential losses compared to other strategies that may involve unlimited risks. Moreover, iron condors offer flexibility in adjusting positions when market conditions change. If one side of the position starts becoming threatened due to an unexpected move in price, traders can make adjustments by rolling one or both spreads further out or closer in time or by widening or narrowing their strikes.

This adaptability allows for potential profits even in volatile markets. However, there are also disadvantages associated with using iron condors. One major drawback is that they offer limited profit potential compared to other strategies, such as directional trades or straddles/strangles. The maximum profit achievable with an iron condor occurs when all options expire worthless at expiration, resulting in only capturing the initial premium received.

Additionally, while iron condors limit downside risk by defining maximum loss upfront, substantial losses are still possible if prices move significantly beyond either spread’s strike price. Traders must be aware that unexpected market moves can result in losses that exceed the initial premium received, especially if adjustments are not made promptly.

Tips For Successful Execution Of Iron Condor Trades

Implementing an iron condor option strategy can be a complex endeavor, but with careful planning and execution, it can yield favorable results. Here are some essential tips to help you successfully execute iron condor trades:

1. Understand the Market: Thoroughly analyze the market conditions before initiating an iron condor trade. Consider factors such as volatility levels, upcoming economic events, and overall market sentiment. A comprehensive understanding of the market will enable you to choose appropriate strike prices and expiration dates for your options.

2. Strike Price Selection: The selection of strike prices is critical to executing an iron condor trade effectively. It is important to choose strikes that are outside the expected range for the underlying asset’s price movement during the trade duration. This will maximize your chances of achieving a profitable outcome.

3. Risk-Reward Ratio: Evaluate the risk-reward ratio before entering into an iron condor trade. Aim for a risk-reward ratio that aligns with your trading goals and risk tolerance. A favorable risk-reward ratio ensures that potential profits outweigh potential losses.

4. Diversification: Diversifying your iron condor trades across different sectors or asset classes can help mitigate risks associated with specific industries or companies’ performance. This diversification approach ensures that any adverse events impacting one sector or asset class do not significantly affect your overall portfolio.

5. Monitoring and Adjustment: Regularly monitor your iron condor trades to ensure they remain within their designated profit range and adjust them if necessary to limit potential losses or capture profits early on. Stay updated on market developments and be prepared to make adjustments accordingly.

6. Risk Management: Proper risk management techniques are crucial when trading iron condors or other options strategies. Set strict stop-loss orders or consider implementing hedging strategies to protect against unexpected market movements that could jeopardize your position.

7. Paper Trading: If you are new to iron condor trading, consider practicing your strategy in a simulated trading environment before committing real capital. Paper trading allows you to gain experience and refine your approach without risking actual funds.

Real-Life Example Of an Iron Condor Trade

To create a more detailed look at the iron condor strategy, let us take a look at a real-life scenario. We’ll scan the options market using Option Samurai.

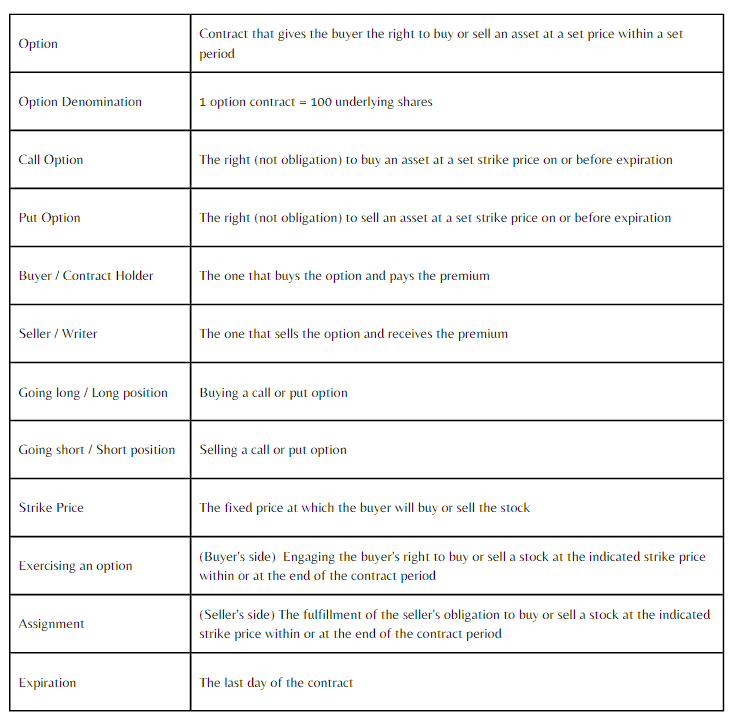

Here we have Dexcom Inc (DXCM) which is currently trading at $101.55. A trader looking to utilize the iron condor strategy using DXCM can follow the steps outlined by Option Samurai’s Scan, which we will break down below.

Bull Put Spread

- Purchase a put option with a $75 strike price and pay a premium of $0.40 to $2.55. This expires on November 17.

- Sell a put option with an $80 strike price and receive a premium of $0.10 to $4.70. This expires on November 17.

- The bull put spread now has a credit from $0 to $215 (premium received less premium paid x 100)

Bear Call Spread

- Purchase a call option with a $130 (further out of the money) strike price and pay a premium of $0.10 to $0.90. This expires on November 17.

- Sell a call option with a $125 strike price and receive a premium of $0.90 to $2.90. This expires on November 17.

- The bear call spread now has a credit from $80 to $200 (premium received less premium paid x 100).

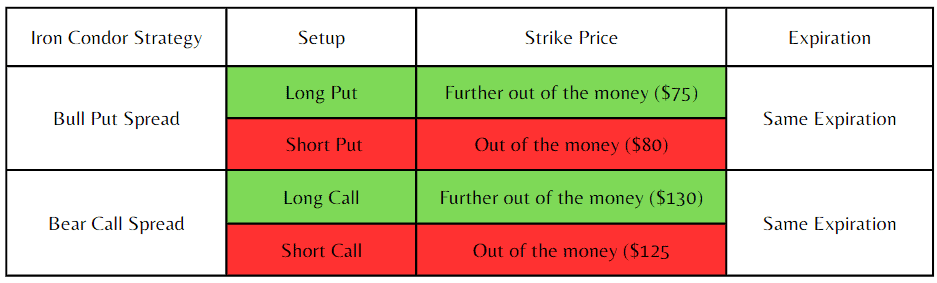

Profit Scenario

With this setup, the trader will receive an upfront premium from the two spreads between $80 to $415. This represents the maximum profit and can only be fully realized if the underlying asset’s price stays between the strike price of the two short options (the short put strike price of $80 and the short call strike price of $125) at expiration. All things equal, an iron condor’s profit zone is wider than certain strategies like the iron butterfly. (Note: The PL Profile shows a maximum profit of only $247.50 because that is the halfway point from $80 to $415.) Additionally, values like Delta and Probability of Expiring Worthless can help analyze a trader’s success probability.

Breakeven Scenario

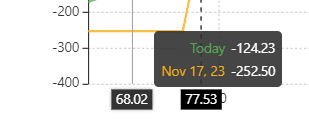

Option Samurai’s PL Profile indicates that the breakeven prices are $77.53 or $127.47. This means the trader loses and gains nothing if the stock price moves to those indicated prices at expiration.

Loss Scenario

Any price movement beyond the indicated breakeven prices results in a loss. The trader’s maximum possible loss is limited to the maximum distance between the spreads multiplied by 100 less the premium received. In this case, both spreads are $5 wide ($80 – $75 and $130 – $125 are both = $5 x 100 = $500), and with the assumed maximum median profit of $247.50, the maximum loss is calculated as $500 – $247.50 = $252.50. If we take the higher end of the profit assumption ($415), the maximum loss will be $500 – $415 = $85. If we take the minimum profit assumption ($80), the maximum loss will be $500 – $80 = $420.

Conclusion

Understanding and managing risk in an iron condor option strategy is vital for successful implementation. While it offers potential income and risk management benefits, traders must be aware of the potential losses if the market moves against their position. The strategy offers limited profit potential compared to other strategies like directional trades or naked options. It also limits losses if adequately managed. Traders must closely monitor their positions throughout their duration, as adverse moves in either direction can result in losses.